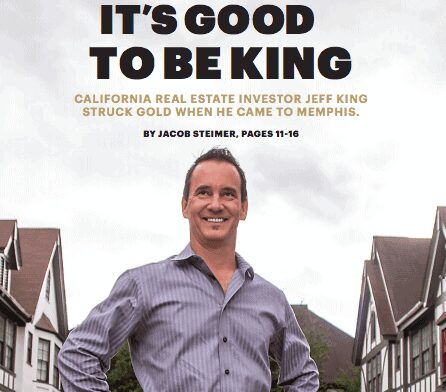

It’s Good to Be King: California Real Estate Investor

Jeff King Struck Gold when He Came to Memphis

Jeff King struck gold in Memphis. The former U.S. Marine is stylish and well-dressed, with dark hair and a soul patch, and he comes across as suave, confident and likable. The California King is also one of Memphis’ newest — and perhaps unlikeliest — real estate moguls. With Meridian, King’s 10-year-old family of companies, he has found undeniable success within Memphis, and the developer has made an impact in the local residential market while gaining little to no public attention. This year, Meridian will manage about 700 single-family and multifamily rental residences, and it will also sell about 100 area homes it either built or redeveloped. In 2018, King anticipates those numbers to grow, as he breaks ground on two new apartment complexes in the Mid-South. King only moved to Memphis two years ago, after managing his growing company from afar. He’s confident the Bluff City has the best rental real estate market in the country, and his impact on it seems destined to grow.

BUILDING CASTLES

In 2005, King and his Meridian co-owner, Kevin Conlon, were helping run Palomar Technologies, a spinoff of Hughes Aircraft Co. that had operations in California, Germany, and Singapore. The company was enduring the tough tech market of the early 2000s, but King felt drawn to leave the sector behind for the then-booming world of real estate.

King lived in California and began studying the industry and even hired a real estate coach. But, it was in August 2005 — as Hurricane Katrina hit — that a light bulb went off.

A self-described opportunist, King realized there would likely be great real estate investment opportunities in areas affected by the storm. He became fascinated by the Gulf Opportunity Zone, a robust federal program to encourage real estate investment in the Gulf states after Hurricane Katrina. King was initially drawn to Jackson, Mississippi, because it was the least damaged area within the Opportunity Zone, and a lot of people from the more damaged Gulf cities moved there.

“I thought, I’m going to go over to Mississippi and check that out,” King said. “I bought a whole bunch of these great rental homes … with essentially no money down.”

King bought his first houses in Jackson in 2007. He renovated them, found tenants for them and then sold them.

Jeff King analyzed more than 300 metropolitan statistical areas, looking for the best markets to flip single-family homes. The data pointed him to Memphis.

Within six months, Conlon decided to become an equal partner in the endeavor. Friends and family back in California quickly realized the wisdom of what the pair was doing and wanted in, too.

“The stock market was going all over the place,” King said. “We had an 8 plus percent return … with far more consistency than the market.”

Meridian generated about $2 million in revenue in its first two years. By the end of 2009, the company had outgrown Jackson and the need to be based in the Opportunity Zone. King and Conlon decided to move north, to Memphis.

“[Originally], it was purely based on trying to find a way to retire early on rentals. It became a company because it worked so well,” King said. “I’ve had multiple occasions to slow down, but it just became so exciting.”

KEYS TO THE KINGDOM

As opportunists go, King considers himself a conservative one. He trusts data more than his gut, and he’s not going to take unnecessarily big risks. So, before deciding to take advantage of the Gulf Opportunity Zone — and before deciding to invest in Memphis — he looked at the data.

King analyzed more than 300 metropolitan statistical areas (MSAs), looking for the best markets in the country to flip single-family homes. The data pointed him to Memphis. “Memphis is the best place in the U.S. for rental real estate,” King said. He took three factors into account in his analysis, and Memphis excelled at all three.

The first factor was maintenance costs, which are low in Memphis because of the city’s lack of snow, hurricanes and flooding. The second was the area’s regulations, which are friendly to landlords. The third was Memphis’ ultra-high rent ratio, meaning landlords can command a higher rent per the value of the house. Memphis’ rent ratio is high because of the demand for rental housing. About 50 percent of Memphis’ housing units are rentals, which is more than in most peer cities.

For comparison, about 46 percent of the housing units in Nashville and Chattanooga are renter-occupied. Little Rock is at 43 percent, while Birmingham and Knoxville come in around 53 percent. In some major cities, such as New York and Boston, the percentage of renter-occupied housing units is even higher — 68 and 66 percent, respectively — while other large cities, such as Portland and Dallas, clock in below 50 percent.

In June, RentRange, a housing market data provider, ranked Memphis’ MSA as having the No. 10 highest average gross yield in the country, at 13.9 percent.

Another advantage of working in Memphis, according to King, is that it’s not hard to guess where the city is going to grow. The Mississippi River prevents much expansion to the west, and there’s not a ton of opportunity to the south.

“It can only go north or east,” he said. “With the exception of some of the gentrification, that progress and growth continue.”

LIVING LIKE A KING

Meridian is active primarily in Bartlett, Arlington, Cordova, Southeast Memphis, and Olive Branch, though it does own some Midtown apartments — the exceptions to its overall suburban strategy.

“I focus on neighborhoods I would live in,” King said.

But, that wasn’t his original approach. King initially bought low-quality homes, renovating and then renting them out for about the market rate — the same approach many local residential real estate investors take.

But, he and Conlon realized maintenance costs on old houses were much higher than they’d expected. To combat this, the company began renovating houses in the $160,000 to $230,000 range and renting them for about $1,300 per month.

“We simply won’t play in the low- end market. Too many people sell these homes and run for the hills,” King said. “We take a lot of pride providing people opportunities to live in quality homes.” After switching to higher-quality renovations, King and Conlon added a property management division about five years ago so they could be more selective with the tenants they chose and have more control over the quality of the product they were selling to investors.

King said this decision was perhaps the best one he’s made at the firm’s helm. “I became really disenfranchised with local property management companies. I soon found doing it ourselves … gave us some control on how our investors fared,” King said. “Repeat buyers only come from people who have had a successful experience with us.”

In late 2013, King and Conlon decided to jump in on the front end of a growing national real estate trend (For more, see the sidebar, “New builds replacing flips,” on page 15.) They added new, “build-to-rent” homes to their company’s repertoire after recession-related foreclosures started dying down and vacant land became easier to find.

To read further about the rental trends see Part II of this article here