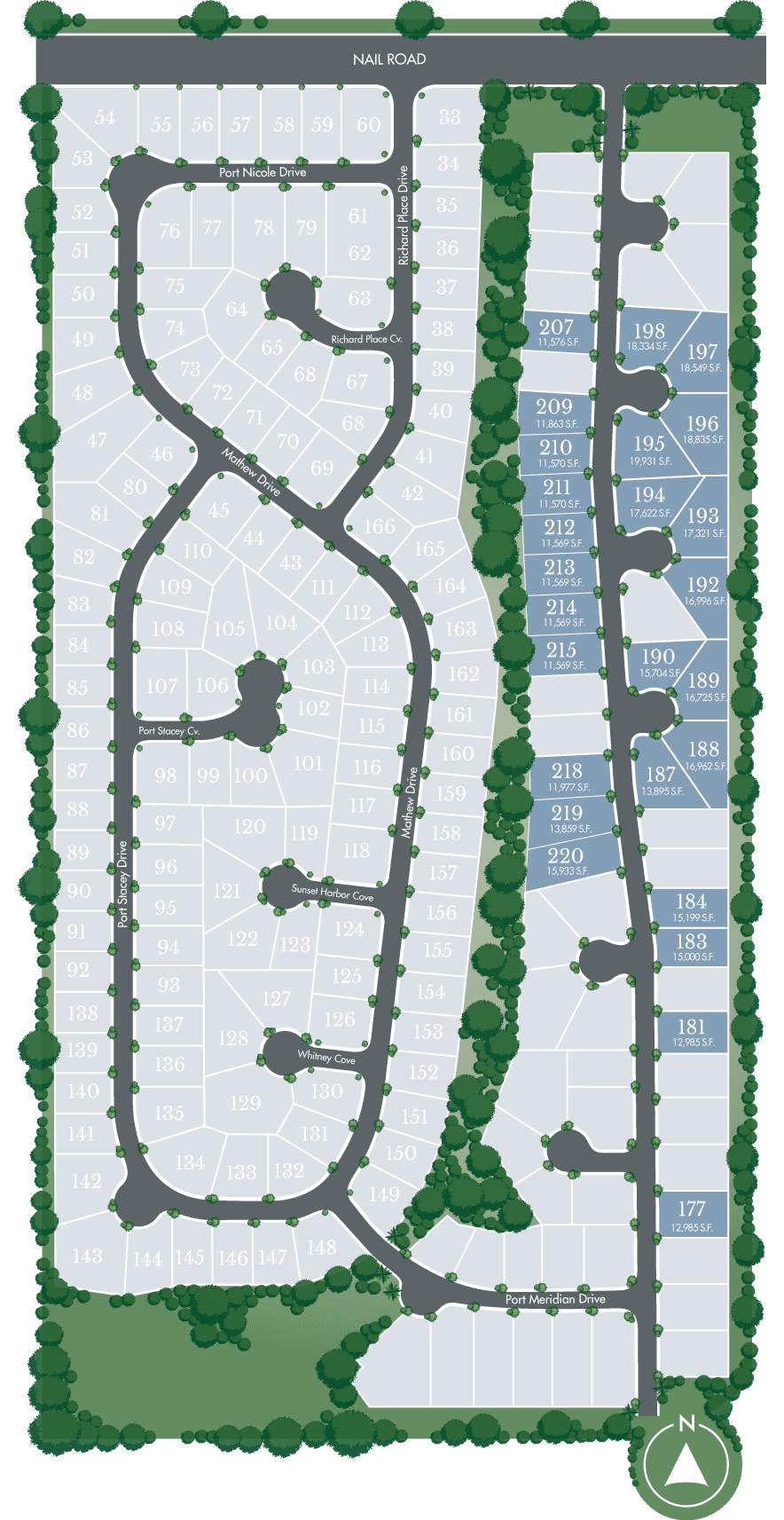

This is your final opportunity to purchase a home in one of Horn Lake, Mississippi’s premier neighborhoods, Nicole Place. Nicole Place is a large, established neighborhood conveniently located off Nail Road and within commuting distance of the area’s biggest employers. This final phase of homes features modern, livable floor plans that are adaptable to the needs of today’s homeowners. Larger, usable backyards offer plenty of space for everything from hosting a barbecue to playing catch.

| Name | Elevation | Plan | Beds | Baths | Square Footage | Load Type |

|---|---|---|---|---|---|---|

| Blue Jay | A | 1666 | 5 | 3 | 2,200 - 2,300 | Front Load |

| Blue Jay | B | 1666 | 5 | 3 | 2,200 - 2,300 | Front Load |

| Canary | A | 1229 | 4 | 2.5 | 1,964 | |

| Canary | B | 1229 | 4 | 2.5 | 1,964 | |

| Cypress | C | 1794 | 5 | 3 | 2,500 - 2,600 | Front Load |

| Dove | B | 1548 | 5 | 3 | 2,214 | Front Load |

| Dove | C | 1548 | 5 | 3 | 2,200 - 2,300 | Front Load |

| Dove | D | 1548 | 5 | 3 | 2,200 - 2,300 | Front Load |

| Finch | A | 1270 | 4 | 2.5 | 1,900 - 2,000 | Front Load |

| Finch | B | 1270 | 4 | 2.5 | 1,900 - 2,000 | Front Load |

| Maple | A | 1128 | 4 | 2.5 | 1,900 - 2,000 | |

| Oriole | A | 1329 | 4 | 2.5 | 2,000 - 2,100 | Front Load |

| Oriole | B | 1329 | 4 | 2.5 | 2,000 - 2,100 | Front Load |

| Starling | A | 1650 | 3 | 2 | 1,600 - 1,700 |

Investor Sales and Support:

(901) 300-2260

Create a free account for full website access and exclusive benefits.💥

🚀 Builder Incentives

🏡 Premium Property Access

💰 Advanced ROI Calculator

📊 The Investor Newsletter

✅ More!

"*" indicates required fields

Already have an account? Sign in.

Sign in for full website access and exclusive benefits.💥

🚀 Builder Incentives

🏡 Premium Property Access

💰 Advanced ROI Calculator

📊 The Investor Newsletter

✅ More!

New to our website? Create a free account.