The Meridian Pacific Properties Leadership team gives an update about The State of the Memphis Single-Family Home Investor Market and High-Yield Turnkey Residential Investments Properties.

Meridian Leadership Team: Kevin Conlon (Co-Founder & Principal), Kent Coykendall (President), Brian Conlon (Business Development), Jordan Varvel (Client Relationship Manager)

Key Points from the Meridian Team:

Kent Coykendall – Memphis Market Overview:

- [Timestamp 6:35] Is there going to be an “eviction bubble”? – Something on everyone’s radar nationally coming into Augst: Eviction Bubble. That’s when the moratorium on evictions ran out through the CARES Act at the end of July. That certainly didn’t happen for us. We had less than a handful of evictions, tabled off to the side while the courts were not opened. They reopened in Memphis and we’ve been moving forward on just a couple, as required, but we just haven’t had that issue. Now we hear this week, that there is going to be a moratorium handed down through the CDC from the Administration. There’s going to be a continuance of the moratorium through the end of December. We still don’t think that that’s going to have a material effect on our business or your investments in Memphis.

- [Timestamp 13:28] Home Prices will soon be increasing due to dramatic increase in lumber costs – the industry got hit with a bit of a shock in the last 30 days, and really in the last 10 days. on this chart, if you look over to the right, right when COVID hit, we definitely saw it drop in pricing for lumber for a couple of months. And then Mills shut down, mills had some logistical problems, mills had – it’s a capital intensive business, but there are employees and some employees got sick; railroad companies, transporting lumber had some issues. The bottom line is prices went down, but now they have roared back. A whole bunch of theories as to why that is; most because of lower capacity and higher demand. This is an unprecedented spike in lumber prices. Now, it’s going to take a little time for the mills to ramp up their capacity. They have to believe that the housing market, which has been strong, is going to stay strong. The housing market has been a bright spot in the economy. This is going to affect it in some ways, but this is also a temporary situation. As you can see by the chart, lumbers a commodity, it goes up and down – the supply and demand – and when the supply’s impacted and when the market is strong you’re going to see some changes in the price. But in the short term, we’re looking at the increased costs of about six to ten percent. Lumber’s anywhere from 13 to 15 percent of the cost of building a home. So when that doubles in a 40 day period. That can’t help but have an effect. Naturally, builders are going to be trying to increase their prices. Last week when this came out, every builder in the country was calling a time out and contemplating their business and trying to figure out what they’re going to do – and we were no exception. We’ve come to a very clear conclusion and we are pressing forward with all of our projects.

View our New Available Inventory of High-Yield Turnkey Residential Investments Properties

Kevin Conlon – Single-Family Residence Investment Outlook:

- [Timestamp 17:36] Build-to-Rent is the Current Star of Investment Real Estate – build to rent is exactly what we do. It’s building a house intentionally for the purpose of renting it and selling it to an investor as opposed to building it and selling it to a retail homeowner. We do some of that but predominately our business is selling to investors. Real Estate’s always been an attractive asset class but right now built-to-rent is the star because retail, hospitality, office, and multi-family have all fallen. And the reason is for that is obviously has to do with COVDI. But each of those asset classes has one thing in common: they all involve a high-density living or working situation; which in the COVID era does not work really well. So a lot of landlords have been struggling with these asset classes. We’ve been seeing prices of these assets defining – with the exception of multi-family. Multi-family has hung in there but it’s just not growing like build-to-rent is. Some forms of industrial real estate are doing decently at the moment as well.

- [Timestamp 24:53] Low-Interest Rates are Driving Demand in the Real Estate Market – Now, owner-occupied mortgages are below three percent. That’s never happened before. Even investor rates, which typically are half a percent to three-quarters of a percent more are still really low, and that has really juiced the investor returns. So investor demand has gone up and homeowner demand has gone up because of these low-interest rates. And interest rates are forecast to remain on the low side for at least the next year. The Fed has been very clear about their interest rate policy. And they intend to keep rates low because it’s going to take a while to dig out from under the hole that COVID has created in the economy.

If you are considering adding to your portfolio, reach out to us directly for more information about our Available Inventory of High-Yield Turnkey Residential Investments Properties

Brian Conlon – Opportunities for Investors:

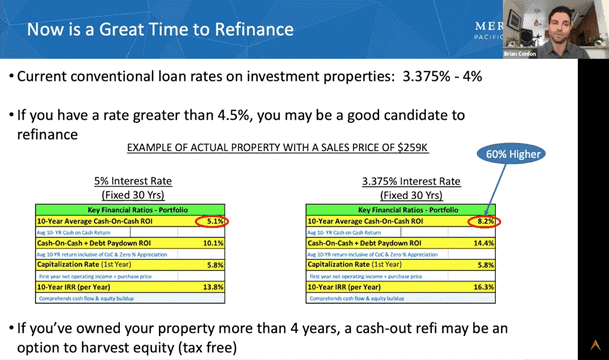

- [Timestamp 29:40] Now is a great time to refinance – if you have an interest rate above four percent, based on what your goals and objectives are moving forward, it might be a good time to refinance, it might not. It really depends on how long that hold term is going to be for you and your particular objectives. The example that we put in here is showing what a 5 percent interest rate vs. a 3.375 percent interest rate would do for an investor. So to me, this is pretty startling. I mean, we’re only talking about a 1.375 difference in the interest rate, but it results in about a 60 percent bump in your cash flow if you’re to go from a 5 percent down to 3.375 on a 30-year fixed mortgage, which is pretty compelling if you find yourself in that situation. Another thing I might suggest is we really had a strong run on appreciation for the past several years. Really, this past year-over-year has been incredibly high. And if you’re looking at finding ways to pull out some equity or get some equity tax-free, a cash-out refinance may be a great option. The rates are just a little bit higher than a conventional refinance, but not much. And the benefit is you get to pull out that equity and you can either re-deploy it, keep it in your rainy-day fund, or you can hold onto that money tax-free.

- [Timestamp 31:16] Insurance Rates Have Dropped in Mississippi – we’ve been working with our Insurance Broker to see what we can do to really mitigate those costs and not sacrifice any level of coverage. Fortunately, our insurance broker recently has had a breakthrough and they now can write for a company known as Travelers that offers strong premiums and coverage and for a much more affordable rate. For my Missippippi properties, in general, is about a 40 percent reduction in premium costs.

The team also reviews the new Portfolio Performance Reports. Learn more here: https://meridianpacificproperties.com/announcing-our-new-portfolio-performance-report/

Questions? Reach out to us directly [email protected]

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.