“As the country transitions to a new administration, what changes should I

consider when filing tax returns on my investment property?”

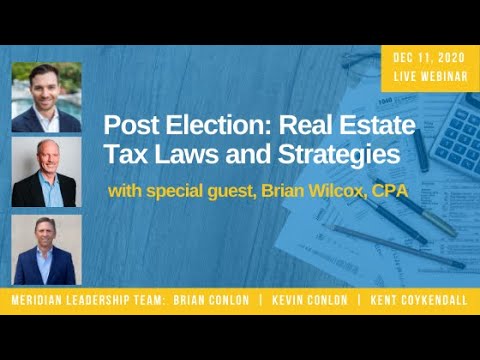

In our recent December webinar, the Meridian Leadership Team sat down with special guest, Brian Wilcox, CPA and Tax Partner at JGD & Associates, LLP to discuss real estate taxes and strategies. During the webinar, we cover important updates in the Memphis and SFR Markets and discuss the powerful benefits of depreciation. Brian also offers his insight and expectations for how to file real estate taxes for 2020 as the country transitions to a new administration. Watch our latest Live Investor Webinar replay or see the key highlights below to learn more.

Key Webinar Highlights

Click a timestamp to watch more on YouTube

Memphis Market Overview – President Kent Coykendall

![]() We’ve been pleasantly surprised that our rent collection rate has remained at 99.5% throughout this year. What has been very surprising to us is that our vacancy rate has remained below 3% through the month of December, which is unprecedented in the Memphis market and in the industry. [Timestamp 3:00]

We’ve been pleasantly surprised that our rent collection rate has remained at 99.5% throughout this year. What has been very surprising to us is that our vacancy rate has remained below 3% through the month of December, which is unprecedented in the Memphis market and in the industry. [Timestamp 3:00]

SFR Update and Power of Depreciation – Co-Founder Kevin Conlon

![]() Depreciation: Real estate depreciation, which is defined as the process used to deduct the costs of buying and improving a rental property, is one of the most compelling tax benefits available to investors. [Timestamp 14:26]

Depreciation: Real estate depreciation, which is defined as the process used to deduct the costs of buying and improving a rental property, is one of the most compelling tax benefits available to investors. [Timestamp 14:26]

![]() Depreciation Tax Benefits are Greater in TN and MS versus states such as CA. [Timestamp 26:08]

Depreciation Tax Benefits are Greater in TN and MS versus states such as CA. [Timestamp 26:08]

Brian Wilcox – Strategies and Tips for Filing 2020 Real Estate Taxes

![]() Post-election tax advice: [Timestamp 32:25]

Post-election tax advice: [Timestamp 32:25]

![]() Depreciation is a benefit, even after you sell your investment property. [Timestamp 34:30]

Depreciation is a benefit, even after you sell your investment property. [Timestamp 34:30]

![]() There are some loss limitations to consider when investing in real estate. [Timestamp 40:24]

There are some loss limitations to consider when investing in real estate. [Timestamp 40:24]

![]() What do we need to do for post-election? Tax planning is on hold until the election is officially over. The long-term view is that taxes are going to go up, which makes RE investing a good place to be because it’s very tax efficient. [Timestamp 43:50]

What do we need to do for post-election? Tax planning is on hold until the election is officially over. The long-term view is that taxes are going to go up, which makes RE investing a good place to be because it’s very tax efficient. [Timestamp 43:50]

Download Presentations

Click here to view The Profound Benefits of Depreciation presented by Kevin Conlon, Co-Founder

Click here to view Benefits of Investing in Real Estate presented by Brian Wilcox, CPA Tax Partner at JGD & Associates LLP

Do you have follow-up questions for Brian Wilcox? You can contact him directly at (858) 587-1000 or [email protected]