This video on how to create an income statement to aid in analyzing the financial performance of an investment property. Creating an accurate profit and loss statement for an income property is a critical step in the due diligence process of analyzing any investment property.

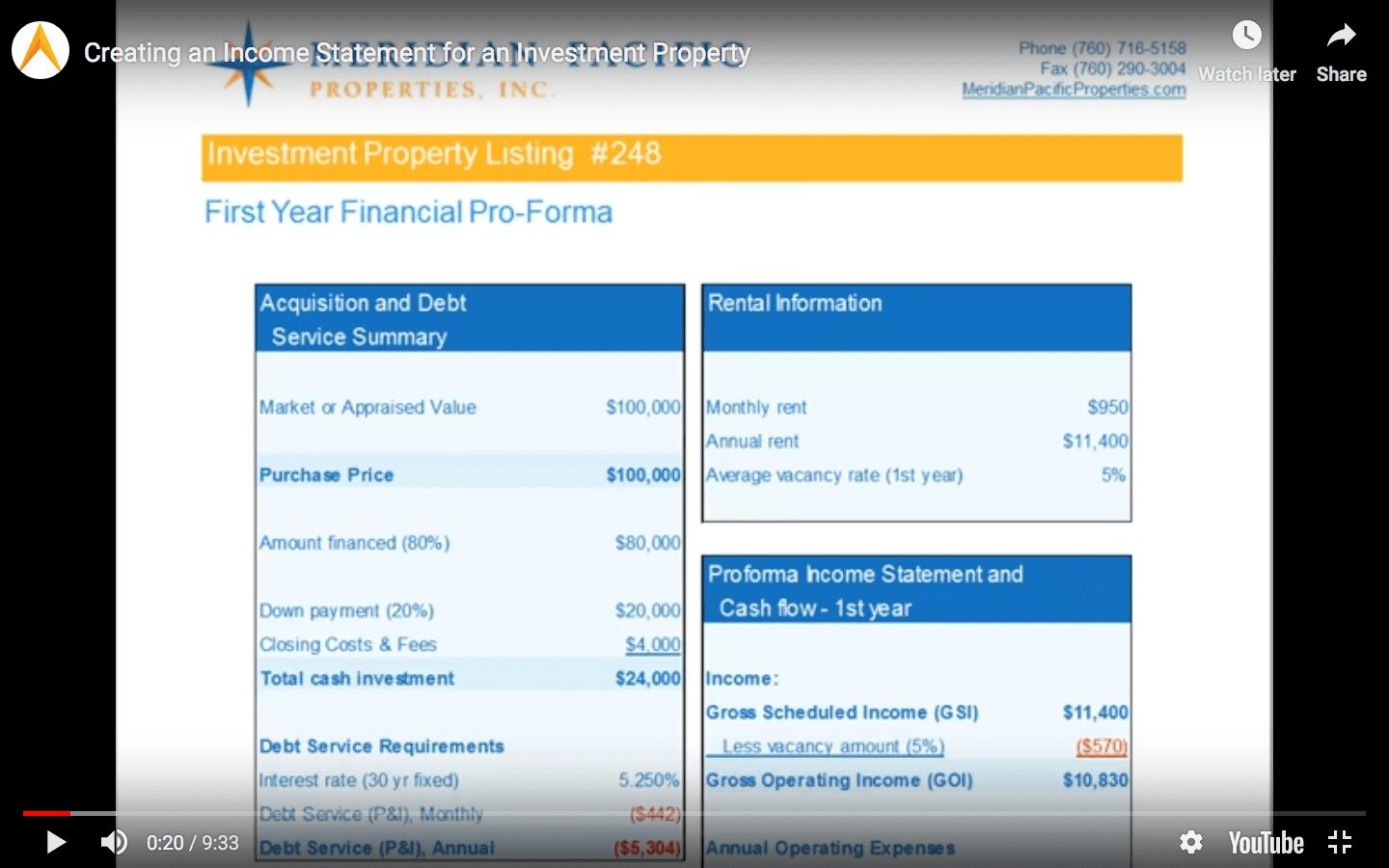

In this video I’m going to describe the basic steps required to create an income statement. Otherwise known as a profit and loss statement for an investment property one might be interested in purchasing. In any investment, it is critical to properly analyze that investment’s financials in order to see if it’s worth investing in in the first place. In order to understand the returns that an investment property will provide us, we need to create an income statement for the property. The income statement is comprised of two sections: The income section and the expense section. With single-family home investments, the income section is typically comprised solely of the rents we can expect from the property. Our gross or overall income is called our gross scheduled income or GSI. The GSI assumes perfection. In other words, the GSI assumes our tenants pay on time and never leave the property.

Expected Income

Since we know this isn’t going to be the case, we need to create an expected income. A realistic income we can count on. In order to do that, we need to apply a vacancy rate to our gross scheduled income. They can see this typically measured as a percentage of the total annual income. In this example, we are using a 5% vacancy rate; which means in a given year where we expect to receive $11,400 in rent. We anticipate that on average our investment home will be vacant 5% of the year. Translated into dollars, 5% vacancy equals 5% of our $11,400 in rental income or $570. By subtracting the expected vacancy from our gross scheduled income, we get our ‘real expected’ annual income on the property – $10,830. Which we call our gross operating income or GOI. The GOI is the income we expect to see in a given year after accounting for vacancy loss on our property.

Property Expenses

Now we need to create the expense section of our income statement. Investment property expenses come in all shapes and sizes but most typically comprise of property management fees, property taxes, insurance, maintenance, and in some cases owner paid utilities and HOA fees. It is very important that you spend time and do adequate due diligence on the expenses you expect to have on your investment home. As this is often the area where investors tend to take an optimistic approach to things. Remember like the home you live in, things will go wrong. Items will need to be repaired and in general, tenants will be harder on the property than you, as an owner, will be. That doesn’t mean you should shy away from investing. It just means that you need to analyze a property knowing these things will probably occur and budget accordingly. Most property expenses are expressed as a flat annual dollar expense such as insurance and property taxes; which are typically paid annually and have a set known value.

Property Management

Other expenses are expressed as a percentage of gross operating income such as property management and maintenance expenses. Note that these are a percentage of gross operating income and not gross scheduled income. This is an important distinction. Property management fees are earned when a property is tenanted and are expressed as a percentage of rents collected. Management fees are generally not collected when the property is vacant. Thus, our property management expenses are calculated as a percentage of gross operating income or income after our vacancy reduction has been calculated. In this case, $1,080 – 10% of our GOI.

Property Taxes

We then want to add a line for our property tax expense. It is important to research what your property tax rate will be as an investor. Remember, in most areas, the property is taxed at a higher rate for investors, especially out-of-state investors. It pays to call the County in which you are planning to invest to determine what your tax rate will be as an out-of-state investor.

These rates can be in some cases two to three times the homeowner tax rate on a property. Thus, if you are purchasing your home from a current homeowner and are looking at what they paid in property taxes, you may be seriously misleading yourself. Some states such as California, tie their property tax rate to the purchase price of the property. Thus, if you’re buying a property for $300,000 from someone who paid $150,000 for the property 10 years ago, you’ll be paying twice the taxes they paid. To ensure accuracy, call the County, let them know what you’re doing and they will let you know how you’ll be taxed.

Homeowners Insurance

Insurance is an easier item to address. The key here is to get a variety of quotes and let the agent know that you are purchasing the property for investment purposes. Insurance rates are truly all over the map and it pays to shop around. Investment property insurance typically includes specialty items such as liability and coverage and rent loss coverage that help protect you as the owner.

Additionally, be sure to check and see if your property requires flood insurance or other mandatory coverages such as windstorm insurance. These additional coverages are not typically disclosed by the seller and can be an unwelcome surprise at closing.

Maintenance

The next expense item we need to account for is our maintenance expense. This item can be tricky, as the rate we use will depend on a number of factors. A general rule of thumb for single-family homes is to use 5% of our GOI for our maintenance beginner. This assumes a typical home 10 to 20 years old in good shape. If the property you were looking at has been recently renovated, your number might be lower than this. On the other hand, if you’re looking at a property with considerable deferred maintenance, you’d likely want to increase that number. In most markets, your tenant will be required to give a security deposit prior to attending a home. This security deposit will help offset many of the day-to-day maintenance expenses associated with getting the unit rent ready for the next tenant. Another factor to consider with respect to maintenance costs is the cost of the repair relative to the rents received. For example, assume we have two properties. One is a $75,000 home with $750 in rent. And the other’s $150,000 home with $1,500 in rent.

Both have been recently renovated and we decided to use 5% as a maintenance factor for both. In the case of the $75,000 home, our maintenance costs are anticipated to be 5% of our annual GOI or $427. In the case of our $150,000 home or maintenance costs are similarly anticipated to be 5% of the GOI or $855. Note the difference. In one case, we’re setting aside $427 per year for repairs and the other, we’re setting aside $855. Now you’ve got to ask yourself, does a water heater in the $75,000 home costs 50% of the one you’d put into $150,000 home? Will replacing the roof costs 50% less? One of the biggest mistakes I see investors make is using a maintenance percentage factor without considering the actual dollar amount they’re setting aside. Granted more expensive homes require more expensive maintenance. You might use nicer carpet or put a nicer roof on a more expensive home. But in the end, the costs of those upgrades aren’t twice the cost of what you’d put into the $75,000 home.

Additional Fees and Expenses

Our last expense category is somewhat of a catchall. In some homes, the owner might be responsible for the utilities and other areas an HOA fee might be an expense born by the owner. If these expenses are something you, the owner, will be paying be sure to enter them into your expense section. Once done, we can add our operating expenses to determine our total annual expense outlay. We can then subtract the total operating expenses from our gross operating income to get our net operating income or NOI. As this is the cashflow we will have coming at us that can be used to pay our debt service or mortgage on the property.

If we have a positive balance left after paying our debt service, the property is considered to be positively cash flowing. If the debt service exceeds our NOI the property would negatively cash flow and would require outside funds in order to maintain. In most cases, negative cash flow is something most investors want to avoid.

In Closing

Well, we’ve done it. We created our income statement. By accurately determining our rental income. We then applied a vacancy factor to determine the income we can actually depend on creating our gross operating income. We then analyze our expenses, accounting for property management and insurance. We also called the County to determine what our property taxes would be as an investor. And lastly, we estimated our anticipated maintenance costs and accounted for any miscellaneous costs that might be associated with the property. We then calculated our net operating income by subtracting our maintenance costs from our GOI and then deducted our debt service to determine what the performer cash flow is on the subject property.