What is a 1031 Exchange?

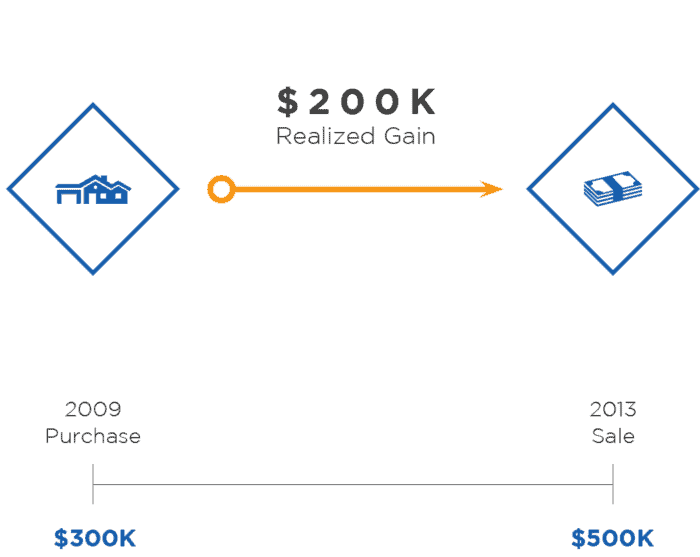

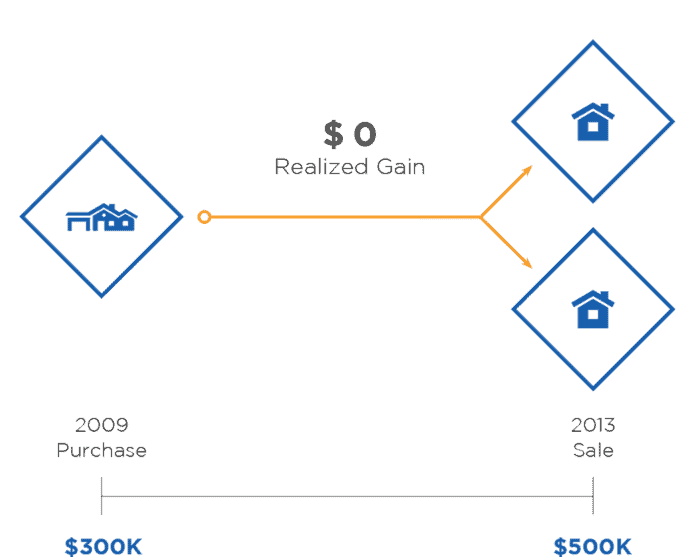

When an investor sells investment real estate for a gain, capital gains tax is due in conjunction with the sale. A 1031 real estate exchange, sometimes known as a 1031x or a tax-deferred, like-kind exchange, offers investors the opportunity to defer payment of capital gains taxes on the investment property gains under certain conditions by exchanging, or purchasing, a like-kind replacement property.

While simplified, the infographic below illustrates the power of a 1031 exchange in real estate. The ability under the tax law to defer payment of taxes enables an investor to have more capital invested than he or she would otherwise, and therefore enables higher returns on investment.

Why Do Investors Use A 1031 Exchange in Real Estate?

Use of a 1031 exchange enables investors to keep a significantly greater amount of their capital invested and generating returns since payment of the tax liability is deferred.

A 1031 exchange in real estate is fairly straightforward to accomplish. Section 1031 of the Internal Revenue Code lays out the guidelines that must be followed to execute a 1031 exchange. While there are a number of categories of assets that can be transacted under a 1031 exchange, the information that follows pertains only to real estate investment property.

Investors over the years have turned to Meridian to help them develop a strategy for improving the returns on their investment properties. Meridian can help with a real estate 1031 Exchange in several ways:

- We help our clients to quickly identify and acquire top-quality replacement properties that deliver superior returns on investment.

- Meridian has already performed the due diligence on the city, the neighborhood, and the properties themselves so that the investor does not have to.

- The properties come with all renovations completed, with tenants and experienced property management already in place. Meridian’s replacement properties are already performing when they are sold.

- In most cases, we are able to close properties quickly on short notice if necessary and have access to lenders who finance investment properties.

- Meridian is not a Qualified Intermediary (QI) but works with Qualified Intermediaries like 1031 Exchange Advantage in San Diego, CA.

What is the Timeline and What Are the Key Deadlines in a 1031 Exchange?

IDENTIFICATION PERIOD:

During the identification period, the investor has exactly 45 days from the date his or her relinquished property has sold to identify in writing the replacement property or properties to be purchased. Identification usually consists of an address and/or legal description. There is no extension of the 45 day deadline under any circumstances. This 45 day timeline is step one of the requirements of the 1031 exchange rules.

EXCHANGE PERIOD:

The second stage of the like-kind exchange is the exchange period, which is the time frame in which the investor must receive (or close escrow) on the 1031 Exchange replacement property. This period ends at exactly 180 days after the date on which the person receives the relinquished property, or the due date for the person’s tax return for that taxable year in which the acquisition of the relinquished property has occurred, whichever occurs first. In the latter instance, an investor can always file for an extension on his or her tax return, in which case the exchange period would still be 180 days.

Violation of either the identification or the exchange periods will result in the invalidation of the 1031 exchange, and the investor must pay the taxes due on the capital gain. Therefore it is important for the investor to not wait until the last minute to either identify or close escrow on the replacement property to stay within the 1031 tax exchange rules.

KEY TERMS & CONCEPTS OF A 1031 EXCHANGE

Replacement Property: The property is purchased in the 1031 exchange from the proceeds of the sale of the relinquished property.

Relinquished Property: The property being sold in a 1031 exchange of which one is transferring gains from.

Boot: Everything of value other than the like-kind exchange property which you receive during an exchange. Any cash that is received would be considered as “boot.” It would be taxable to the extent of gain “realized.”

Like-kind Exchange: For investment property to qualify under section 1031, the properties exchanged must be of “like kind,” which means that they are of the same nature or character, even if they differ in quality. They must be held for a productive purpose in a business or trade, such as for investment.

“Like-kind exchange” does not mean “identical.” For example, single-family homes can be exchanged for apartments, office buildings can be exchanged for warehouses or land, etc.; these are all various forms of investment real estate and are considered like-kind. But personal property, such as machines or equipment, is not considered real property and is not like-kind for the purpose of doing a 1031 exchange with investment real estate.

The property being sold in a 1031 exchange is known as the relinquished property, and the property being purchased in the exchange is called the replacement property. It is acceptable for either the relinquished and/or replacement property to be multiple properties, as long as their aggregate values are considered for the exchange. For purposes of the ensuing discussion, “property” will be used to indicate either one or multiple properties.

Qualified Intermediary Required: Under the 1031 exchange rules, the proceeds from the sale of the relinquished property must be handled by a third party qualified intermediary (QI), sometimes known as an exchange facilitator or exchange accommodator. The proceeds from the sale must never be in the possession of the investor or their agent, or the 1031 exchange will be considered invalid. The QI cannot be a person or entity with whom the investor has had a family or prior business relationship.

A QI is an independent organization whose only relationship with the investor is to handle the exchange transaction funds on the investor’s behalf. The QI’s duties on behalf of the investor include:

- Receiving the proceeds from the sale of the relinquished property and holding them in escrow.

- Disbursing the proceeds for the replacement property on behalf of the investor.

- Managing the 1031 exchange process on behalf of the investor to ensure the 1031 exchange is in compliance with the IRS code, including all of the paperwork and meeting the timing deadlines.

- The QI can perform all of their duties without ever taking title to the properties involved in the 1031 exchange transaction.

A good QI typically specializes in 1031 exchange transactions and should be adequately bonded and insured. They make their money by charging transaction fees to the investor and/or by retaining the interest on the funds that are held on behalf of the investor.

It is strongly recommended that choosing a good QI be the first step taken by an investor contemplating a 1031 exchange, even before listing the relinquished property for sale. The QI can explain in detail the entire process and 1031 tax exchange rules, validate that the transaction being contemplated is eligible for a 1031 exchange, ensure that all of the rules are complied with and that all of the required paperwork is in order. Because a 1031 exchange is governed on U.S. federal tax law, it is not important that the QI be in the same state as the investor. All of the transactional details can be handled by online and by phone. The Federation of Exchange Accommodators is the professional trade association for 1031 exchange QI’s for and is a good place to find them.