During these unprecedented times, there are many questions within the investor market. The good news is that the Single-Family Residential market continues to hold stable and deal activity remains active. Interest rates hit historic lows again and this can be a great time to take advantage. Here are some tips you can do right now that will help increase your return of investment and potentially add another investment to your portfolio.

-

Have you owned a property for more than 5 years?

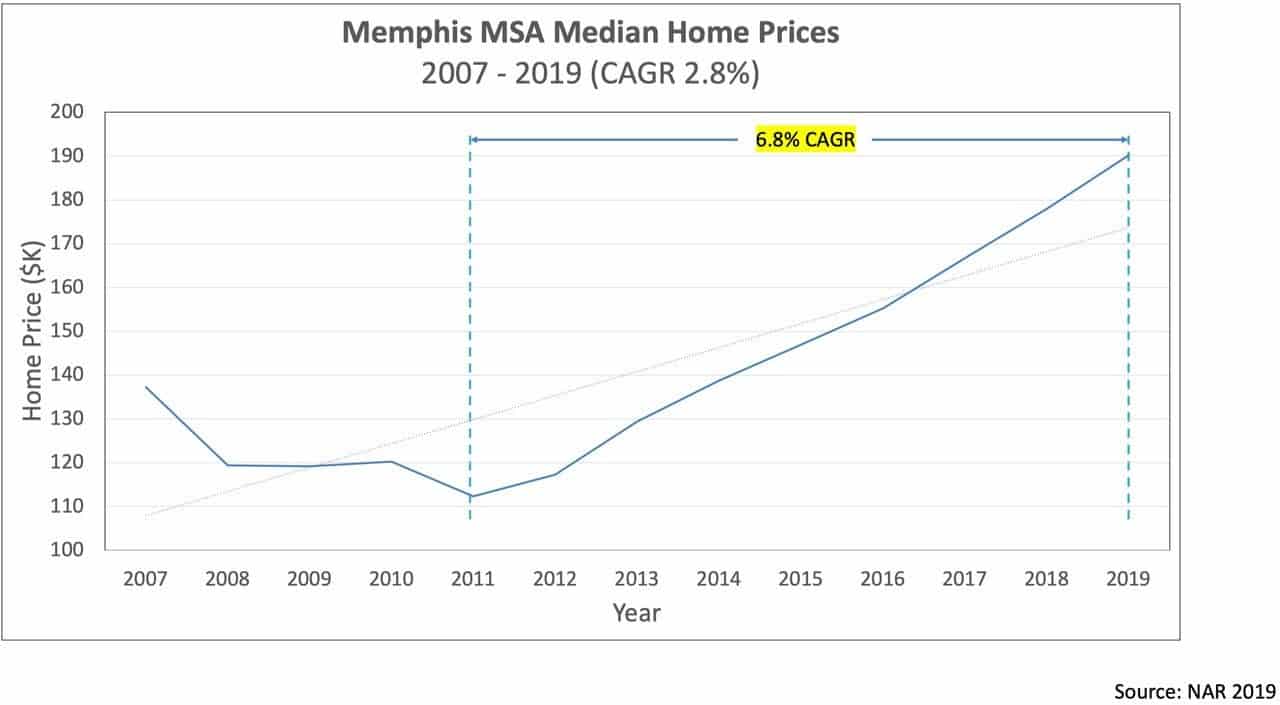

Chances are high that you have strong appreciation on your property. The majority of the Memphis MSA has gone up in value over the past several years. It has averaged about a 6.8 percent annual appreciation year over year since 2011.

-

Interest Rate above 4.5%? Refinance

There is an opportunity for owners with existing homes to do a cash-out refinance. Pull equity out of the property that has appreciated over time, tax-free. Currently, with such low-interest rates, investors can redeploy that money to maximize their IRR or hold on to the cash. Rates on investment properties are as low as 3.25 percent for a 30-year fixed-rate. It’s a great time to act on a cash-out refinance.

-

Maximize Internal Rate of Return

Lowering the interest rate will instantly boost the investors Internal Rate of Return. It will also allow you to potentially purchase additional homes with little to no money down. Meridian currently has homes at the $195K price point. This means you can pull $50K from your investment to go towards a new property. Most investors who have owned a home for over 5 years could potentially have this amount of equity built up. Now is the time to lock in a new, low-interest rate before it’s too late.

Need help finding a lender? Contact us for references.

We are happy to help find the best option for you. If you would like to discuss future investment opportunities, please contact our office or email us directly at [email protected]

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.