The Real Estate Market Slowed. Should Investors Be Concerned?

Is there anything that an investor should be concerned about with the real estate market’s slowing down over this past month?

A Turnkey Solution for Real Estate Investors from Meridian Pacific Properties

Meridian provides new and experienced investors with a turnkey solution to purchase and profit from residential real estate rental properties. In this video Kevin Conlon, Principal and Co-Founder or Meridian Pacific Properties, explains how they are able to generate immediate cash flow and long term appreciation from their build-to-rent properties.

1031 Exchange Basics

When an investor sells investment real estate for a gain, capital gains tax is due in conjunction with the sale. A 1031 real estate exchange, sometimes known as a 1031x or a tax-deferred, like-kind exchange, offers investors the opportunity to defer payment of capital gains taxes on the turnkey investment property gains under certain conditions by exchanging, or purchasing, like-kind replacement properties.

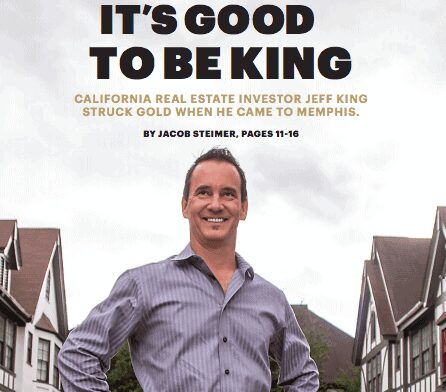

The King of Memphis Real Estate Investors

Jeff King struck gold in Memphis. The former U.S. Marine is stylish and well-dressed, with dark hair and a soul patch, and he comes across as suave, confident and likable. The California King is also one of Memphis’ newest

4 Tax Benefits of a 1031 Real Estate Exchange

There are significant tax benefits when you take advantage of a like kind exchange using a 1031 tax deferred real estate exchange. Find out how to use replacement properties and turnkey investment properties for your 1031 exchange

History of the 1031 Exchange Program

What is a 1031 Exchange? A 1031 exchange is a tax strategy under Section 1031 of the internal revenue code. You can do a like kind exchange for 1031 exchange properties, investment properties or replacement properties.

5 Little Known Facts that Could Affect Your 1031 Tax Deferment

A 1031 tax deferred exchange involves trading two properties to defer taxes. The two properties do not necessarily have to be identical. Find turnkey investment properties and replacement properties for your 1031 like kind exchange.

Live Webinar - The Memphis SFH Investor Market mid Covid-19

Meridian will be hosting virtual events in the upcoming weeks. Join us for an Investor Round Table Discussion – a Live Webinar with the founders of Meridian to explore important and current topics and answer any questions. Register here Roundtable Discussion – Meridian & Investors DATE: Thursday, April 16, 2020 TIME: 10:00 AM – 11:00 […]

A 7 Step Guide to Choosing Your 1031 Exchange Service

Real estate investors seeking to preserve the value of their assets, may find a 1031 exchange an excellent solution. With alike kind exchange you can find 1031 exchange properties, turnkey investment properties and replacement properties to defer taxes.

Which Real Estate Investment is Best for You? And Why Meridian Can Guide You There

What kind of questions would you ask a potential investor if they were to determine whether a REIT or a purchasing real estate would be a better option for them? I always like to ask an investor to be clear on what your objectives are.