The internal rate of return or IRR is an important calculation used frequently in real estate investing to determine if the investment is worthwhile. Investment is generally considered worthwhile if the internal rate of return is greater than the return of average similar investment opportunities. Used properly IRR can be used as a tool to compare the financial strength of different investment property opportunities. IRR is defined as the rate of return that would make the present value of future cash flows, plus the final market value of an investment or business opportunity, equal to the current market price of the investment or opportunity. As defined, IRR may sound confusing and difficult to understand. However, in practice and with a few examples, you will see the simplicity and power of this calculation.

For some investments like bank accounts, the internal rate of return is easy to figure because the bank tells you what it is. For example, a 5% simple interest bank account has an internal rate of return of 5%. For other investments you have to do some work to calculate the internal rate of return. This is especially true of investments like the purchase of investment property. These kinds of investments generally don’t pay money in nice, even amounts like the bank account does. Nevertheless, you can calculate an internal rate of return for these investments and use it to decide which investments pay best.

Let’s assume we have $24,000 to invest and are evaluating two different investments. One of our options is to place the funds with a bank advertising a 5% interest rate. The other’s to purchase an investment property. We’re looking to hold the investment for five years. One way to compare investments is to calculate the internal rate of return for each one. To evaluate investments and calculate the internal rate of return we need to determine the income stream or cash flows for the investment first.

We will evaluate the bank account option first. We plan on placing $24,000 in a 5% simple interest bank account. The account will pay us 5% interest or $1,200 each year. We plan on withdrawing these funds for living expenses so they won’t stay in the account and compound. At the end of the fifth year, we’ll take all the funds out. I’ve created an income stream worksheet so that we can model the cash flows of this investment. The initial deposit is represented as a negative number, as the funds flow out from us. In years one through five we will get paid $1,200 which is 5% of the $24,000 initial investment. These payments are positive numbers showing that the money flows to us. Note to keep things simple, we’re showing that interest is paid annually. Most real-life bank accounts pay interest monthly. At the end of the fifth year, we cash out and take both our interest earned that year and our initial deposit out of the bank. IRR calculations require both a purchase and a sale. Or in this case, a deposit and a withdrawal as a purpose of an IRR calculation is to measure the return of the investment from beginning to end.

Now that we’ve created the income stream for our bank account investment, we can calculate the internal rate of return for this income stream.

Excel provides us with a function for exactly this calculation. We simply pick the cell in which we want to create the calculation. We then pick the function button, type IRR into the search box and the internal rate of return function will be listed. The function is looking for our income streams, so we will highlight our income stream starting with the deposit and ending with their final withdrawal. As we initially surmised, our bank account investment provides us with a 5% internal rate of return.

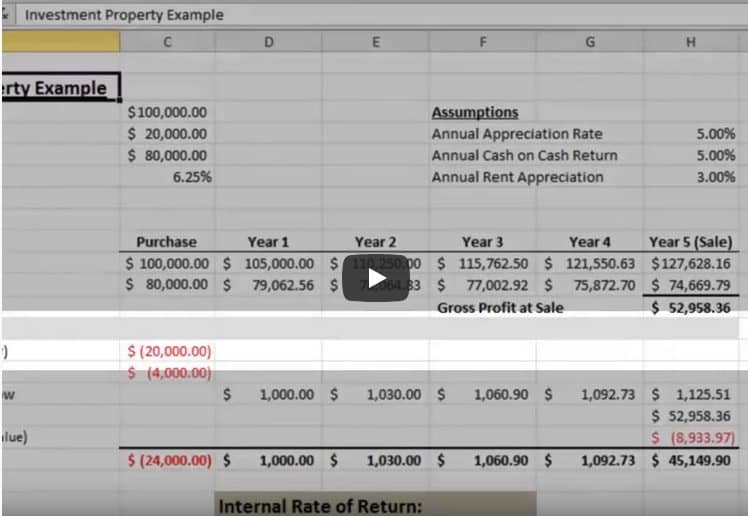

Now let’s determine the income stream for our investment property option. The property we are looking at purchasing has a purchase price of $100,000. We plan on getting a mortgage and we’ll be putting 20% down on the property, leaving a loan amount of $80,000; which will be financed at a 6.25% interest rate. Our total outlay with this investment will be our $20,000 down payment and $4,000 in closing fees, which equals the same dollar value as our bank account option.

Since these investment returns aren’t fixed like the bank account investment, we need to make some assumptions regarding the performance of this investment. Over the five year hold period.

Our research has shown that the investment property we are evaluating is expected to have a 5% annual appreciation rate. The property cash flows at 5% after all expenses and we expect this cash flow will increase by 3% annually due to rent increases.

First, we’ll apply our appreciation rate to the property value in order to determine what effect appreciation will have on our investment. By subtracting the year five value from the initial purchase price, we see we’ve gained approximately $27,000 due to appreciation.

We then need to calculate our loan balance at the end of our investment. Since we have a mortgage on this investment over the five year hold period, our monthly mortgage payments will reduce the balance on our mortgage. The balance at the end of our five-year hold is what we’ll need to pay off with the proceeds from the sale. The difference between our five-year market value and the loan balance represents the gross profits from this investment.

In order to calculate our internal rate of return, we need to construct our income stream for the investment. Our initial outflows of our down payment on the property and the cost required to close a transaction and acquire alone. Combined, we were paying $24,000 in order to obtain this investment property. Our annual positive cash flow on this property is 5% of our down payment amount or $1,000 in year one.

This cash flow stream increases annually owing to our rent appreciation factor of 3%. When we dispose of our investment property, we’ll gain our gross sale profit of approximately $53,000. We also have costs associated with the sale which need to include our income stream. In this example, we expect to pay a real estate agent 6% of the sales price as a sales commission for helping us sell it and are assuming 1% in seller closing costs for a total of eight $8,900. As we summarize the columns, our annual income stream is revealed and we can use Excel to calculate the internal rate of return on this investment.

Now we can compare our bank investment option against our investment property option and see which investment provides us a best return. The internal rate of return is a great way to measure returns on investment properties that pay out cash flows over the life of the investment. When investing, funds receive earlier in the investments term are considered more valuable than money received later. Let’s look at a final example that would demonstrate this.

Using our property investment example, we calculated that we had a 16.42% internal rate of return. This return is calculated based on our 5% annual cash flow with the sale of the property in year five. If we total the incoming cash flows over the life of this investment, we see that they total $49,333.

Now let’s assume we have a similar property. However, this one provides twice the annual cash flow. While this property cash flows better, it doesn’t appreciate as much and we only net $40,966 at closing. I set this up so that the total incoming cash flows on this property are the same as our previous example. The only difference is that this investment provides more cash flow early in the investment’s life with less at the end. We then calculate the IRR.

Our IRR increased in the second example to 17.43% over the first. Assuming all other factors are equal, this investment provides a better overall return, even though in dollar terms, it provides the exact same dollars over the five-year hold. If you think about it, this makes sense. The earlier we receive funds from an investment, the earlier we can reinvest those funds. In essence, compounding our returns.

As you can see, the internal rate of return or IRR is an important calculation used in real estate to compare investments to each other. When we invest in real estate, we are typically dealing with properties that provide cash flow streams. The IRR takes into account the benefit and timing of these cash flows and provides us with a great measure of our investments performance. For simplicity, all my examples have had the income and outflows at one-year intervals. Real-life investments can have income and expenses at irregular times, but the principles of evaluation are the same.