When people talk about Memphis, the conversation is often incomplete. While many associate the city with older multifamily housing and the challenges that come with managing lower-income rentals, they often overlook the strength of the broader Memphis metropolitan area. This region stretches across three states, includes over 1.3 million people, and encompasses some of the fastest-growing, most desirable suburbs in the Southeast.

Real estate investors — especially those coming from expensive coastal markets — are increasingly taking a second look at Memphis. Why? Because this region offers something few other markets can right now: affordability, rental demand, and long-term economic fundamentals.

What This Article Covers

- What makes up the Memphis MSA

- Submarkets worth watching

- Why Memphis is strong for single-family rentals

- A 2025 market update

- How investors are using 1031 exchanges

- Best investment properties for sale in Memphis

Understanding the Memphis MSA

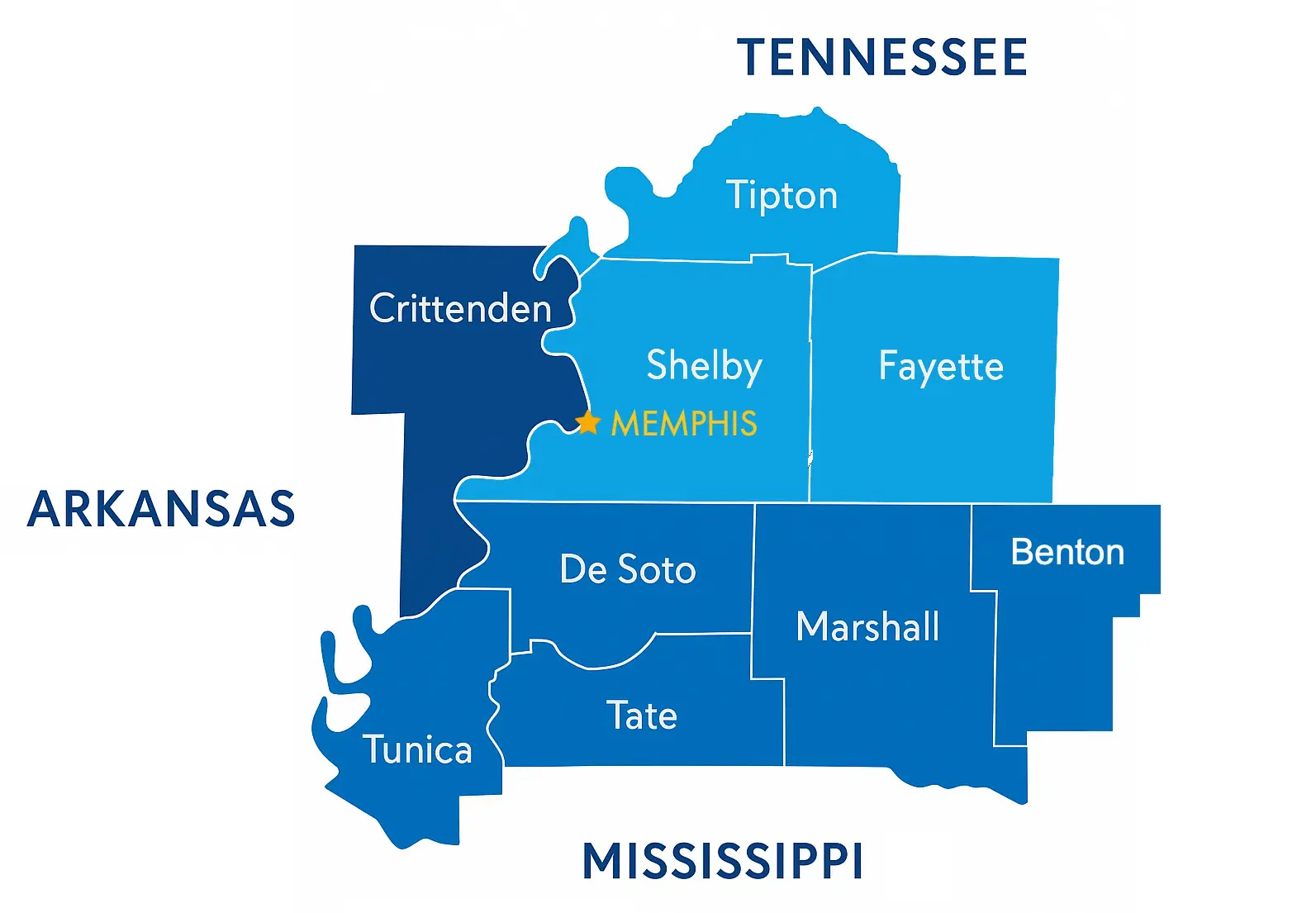

The Memphis Metropolitan Statistical Area (MSA) is a tri-state region that includes parts of Tennessee, Mississippi, and Arkansas. It is composed of eight counties: Shelby, Fayette, and Tipton in Tennessee; DeSoto, Marshall, Tate, and Tunica in Mississippi; and Crittenden in Arkansas. Anchored by the city of Memphis, the MSA is a transportation and logistics hub — home to FedEx’s global headquarters and one of the busiest freight airports in the world.

The region’s central location, business-friendly tax environment, and diverse economy have helped it remain a steady performer in real estate. Population growth in the surrounding suburbs continues to outpace the urban core, driven by families and professionals seeking affordability, space, and quality of life.

Challenging the Memphis Narrative

Memphis has received attention for its challenges, but real estate investment is all about location — and within the MSA, location varies dramatically. Investors focused solely on city center data may miss out on the economic vibrancy of its surrounding areas.

Suburban municipalities like Olive Branch and Oakland have among the lowest crime rates in their states. They boast A-rated schools, rapidly appreciating home values, and new development pipelines that reflect local economic health. These are areas with professional tenants, consistent lease renewals, and strong civic planning.

At the same time, Memphis proper has begun to see notable reinvestment in infrastructure, logistics, and tourism. The Downtown core and medical district are both undergoing revitalization, with new apartments, hotels, and mixed-use developments drawing attention from national firms. FedEx’s continued investment in the region remains a stabilizing force, along with expansion at St. Jude Children’s Research Hospital and the city’s emergence as a hub for healthcare logistics.

Memphis International Airport recently completed a $245 million modernization project, improving capacity for both passengers and cargo. Combined with the city’s river access, rail lines, and interstate proximity, this strengthens Memphis’s long-term economic prospects — and with them, long-term housing demand.

The net result? While challenges remain in some pockets, the broader Memphis region continues to improve its fundamentals, attract capital, and expand opportunity. For investors, it means there’s both growth and resilience to be found — particularly in the well-positioned suburban markets we focus on at Meridian Pacific Properties.

Why the Real Opportunity Lies Beyond the City Limits

When people think about investing in Memphis, they often picture the urban center — but that’s only part of the story. While Memphis city proper offers some opportunities, the most attractive and resilient investments are often just outside it. The surrounding suburbs benefit from lower crime, stronger school systems, newer infrastructure, and a growing population of middle- and upper-income renters.

These areas are not just different by zip code — they represent a fundamentally stronger investment profile. Families are moving in, businesses are expanding, and the local governments are development-friendly. New construction thrives here because demand is strong, tenants stay longer, and the long-term fundamentals point toward growth.

This is why Meridian Pacific Properties has focused its build-to-rent strategy on the region’s top-performing suburbs — not the city core.

Where We Build: Top Memphis Submarkets

Meridian Pacific Properties focuses on high-performing submarkets within the MSA. Here’s why each matters:

Olive Branch, MS – Repeatedly ranked among the best places to live in Mississippi, Olive Branch features highly rated schools, abundant parks, and a strong retail base. According to the U.S. Census Bureau, it has grown by over 40% since 2000.

Southaven, MS – Mississippi’s third-largest city, Southaven benefits from proximity to Memphis International Airport and major employment hubs. It offers a strong balance of affordability and livability.

Horn Lake, MS – With lower home prices than neighboring Olive Branch and Southaven, Horn Lake provides excellent entry points for investors looking to maximize cash flow while still enjoying suburban infrastructure.

Oakland, TN – One of Tennessee’s fastest-growing towns, Oakland has seen a population surge due to its low taxes, newer schools, and the availability of land for development. Property values in Oakland have appreciated more than 35% over the last five years.

📍 Where we’re building – Try our Interactive Map

Why We Build in These Areas

“We’ve spent years evaluating where the strongest investments are, and it’s clear — the suburbs offer better tenants, lower maintenance, and more predictable returns,” says Brian Conlon, Director of Business at Meridian Pacific Properties. “Our goal is to deliver long-term value in markets where we can stand behind every home we sell.”

The suburbs we target meet a key set of criteria:

- Strong demographics: Professional tenants, growing populations, and median incomes above state averages.

- Affordability and value: Median home prices between $275,000–$350,000 offer far better rent-to-price ratios than coastal markets.

- Cash-flow potential: New construction homes in these areas commonly achieve 6%+ gross yields with minimal maintenance.

- Stable infrastructure: Good schools, healthcare access, and retail amenities support tenant retention and property value growth.

- Property management scalability: The concentration of assets enables efficient, high-quality local management.

| Category | Memphis (City Core) | Meridian Focus Suburbs (e.g., Olive Branch, Oakland) |

|---|---|---|

| Crime Rate | Higher than U.S. average | Significantly below state averages |

| School Ratings | Mixed (varies by zip code) | A- to B+ rated public schools |

| Tenant Type | Broad mix, more transience | Stable, professional families |

| Property Age | Older housing stock | New construction homes |

| Cash Flow | Often positive, but volatile | Consistent 6–8% gross yields |

| Rent Stability | Varies by area | Strong lease renewals, low vacancy |

| Property Management Efficiency | Harder to scale | High concentration of homes = operational scale |

| Long-Term Appreciation | Slower, block by block | Steady, tied to new development and schools |

📊 Memphis Market Evaluation – Read the full report

Memphis Real Estate Market Update (2025)

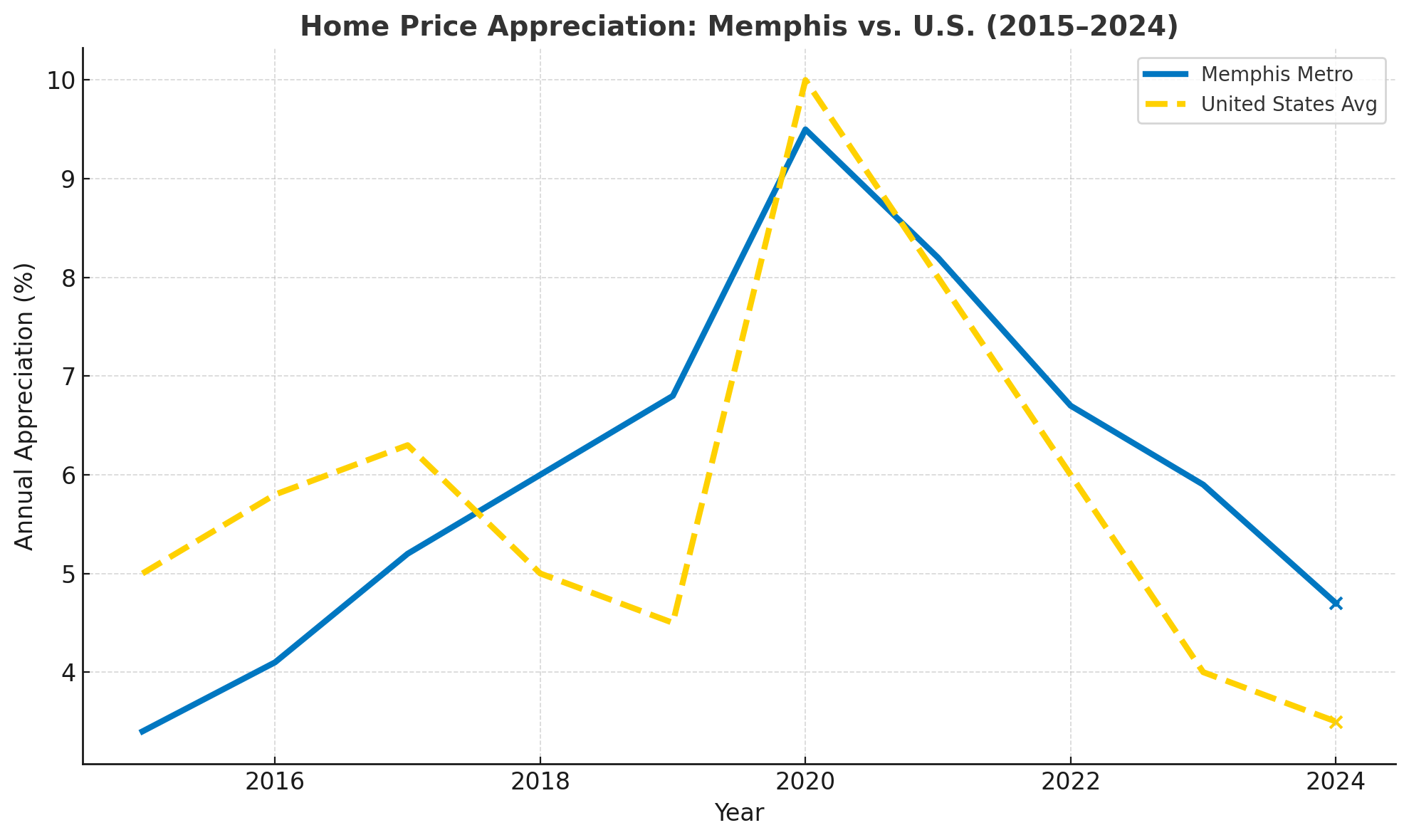

The Memphis real estate market is drawing national attention for all the right reasons. Realtor.com recently named Memphis one of the top housing markets for 2024–2025, projecting home sales growth of 10.3% and price growth of 5.4%. That outpaces most major metros and signals investor confidence and increasing demand.

With a steady job market, population growth in surrounding counties, and relative affordability, Memphis is becoming a more attractive destination for both renters and buyers. The cost of living is nearly 15% below the national average, which continues to drive migration from higher-cost areas.

High occupancy rates and consistent rent growth reflect a healthy balance between supply and demand — and Memphis still offers investors an opportunity to buy below replacement cost in many cases. This gives new construction properties an edge, especially in quality suburban markets.

Experts expect the Memphis metro area to remain resilient through market fluctuations due to its economic anchors: logistics, healthcare, education, and manufacturing. As interest rates stabilize, many anticipate more activity in both resale and new build markets by late 2025.

In 2025, the Memphis real estate market remains one of the few major U.S. metros where inventory remains tight but price points are still attractive. Key highlights:

- Median home price in Memphis metro: $253,000 (compared to $758,000 in Los Angeles or $695,000 in Seattle)

- Gross rent yields on new construction SFRs: 6–8%

- Average rent growth (2020–2024): 4.7% annually

- Occupancy rates: 95%+ (Meridian Property Management averages 96.5%, outperforming typical regional benchmarks)

Suburbs like Oakland and Olive Branch are benefiting from both inbound migration and low inventory, driving consistent appreciation without speculative spikes. Builders continue to favor these areas for their pro-development policies and infrastructure readiness.

Why Memphis Is Ideal for Single-Family Rentals

Single-family rentals (SFRs) play a central role in meeting Memphis’s housing demand. In many of the suburbs where Meridian builds, over 35% of households are renters — and a significant share are families who want the benefits of a home without the financial or lifestyle commitment of ownership.

The advantages for investors include:

- Tenant stability: Longer lease durations and lower turnover

- Higher quality tenants: Suburban SFRs attract renters with stable jobs and stronger credit

- Favorable regulatory environment: Tennessee and Mississippi remain landlord-friendly compared to states like California or New York

- Lower operating costs: Lower taxes and insurance premiums reduce drag on returns

🔎 Search Investment Properties For Sale Near Memphis

1031 Exchange Investment Potential in Memphis

“We’ve worked with hundreds of 1031 investors moving out of California or New York,” says Brian Conlon, Director of Business at Meridian Pacific Properties. “They’re shocked by how much more income and control they gain when they move into a Memphis portfolio.”

Memphis has become a hotspot for 1031 exchange buyers, especially those leaving high-cost states. Here’s why:

- Ability to exchange into multiple cash-flowing properties from the sale of a single high-value asset

- Turnkey inventory ready for quick identification and close within IRS timelines

- Property management already in place, removing friction for out-of-state investors

- Builder incentives like rate buy-downs or closing credits available on new homes

For example, a $1M sale in California can often yield three to four new construction rentals in Memphis, each generating positive cash flow — plus professional management and tax benefits.

Who Is Investing in Memphis?

Real estate investors in Memphis tend to fall into a few key profiles:

- 1031 exchange buyers seeking to reinvest capital gains from high-cost markets like California, New York, or Washington into stronger yield markets.

- Out-of-state investors looking for professionally managed, income-producing properties.

- First-time investors priced out of their local markets and looking for a more affordable entry point.

- Retirees or passive investors prioritizing monthly income with minimal involvement.

Memphis appeals to these groups because of its blend of price, cash flow, and professional property management — making it one of the more accessible and profitable options for real estate investors today.

Memphis vs Other Investment Markets

| Market | Median Home Price | Gross Yield | Rent Control | Landlord-Friendly? | Property Tax Rate |

|---|---|---|---|---|---|

| Memphis, TN | $253,000 | 6–8% | No | Yes | 0.73% |

| Austin, TX | $467,000 | 3–4% | No | Yes | 1.81% |

| Los Angeles, CA | $758,000 | 2–3% | Yes | No | 1.25% |

| Atlanta, GA | $390,000 | 4–6% | No | Yes | 0.87% |

Sources: Zillow, Redfin, SmartAsset, ATTOM, Realtor.com, and internal analysis by Meridian Pacific Properties (2024–2025).

Expanding Business Landscape in Memphis

Major employers continue to expand in the Memphis metro area, strengthening job growth and long-term housing demand. Key developments include:

- BlueOval City (Ford and SK Innovation): A $5.6 billion electric vehicle and battery manufacturing campus underway in nearby Stanton, TN, projected to create over 6,000 jobs.

- Amazon: Multiple fulfillment centers and ongoing regional expansion have made Memphis a key logistics hub.

- St. Jude Children’s Research Hospital: Investing over $12 billion in campus expansion and research hiring.

- FedEx: Continues its commitment to the region with recent infrastructure upgrades and workforce investments.

- Nike and Medtronic: Both maintain large operational and distribution footprints in Memphis.

This business growth underpins strong employment, supports tenant demand, and reinforces Memphis’s reputation as a strategic economic center.

Market Growth Drivers to Watch

Memphis is positioned for continued strength due to:

- Job growth: Anchored by FedEx, St. Jude, and BlueOval City (Ford), plus recent expansions in Memphis’s logistics and manufacturing base. Amazon continues to grow its Memphis operations, and the BlueOval SK Battery Park project is expected to bring over 6,000 jobs to West Tennessee. Additionally, the I-269 corridor near Olive Branch and Byhalia is seeing strong industrial development interest from national brands.

- Affordable living: Cost of living ~15% below national average

- Population trends: Suburbs like DeSoto County (MS) and Fayette County (TN) experiencing rapid growth

- National recognition: Realtor.com ranked Memphis among the top 10 housing markets for 2024–2025

Common Questions from Investors

Is Memphis a safe place to invest?

Yes — particularly the suburban submarkets where crime rates are among the lowest in the region.

Do I have to manage the property myself?

No. Meridian offers full-service property management for out-of-state investors.

What kind of returns should I expect?

Most new construction homes generate 6–8% gross yields, with potential for long-term appreciation and tax benefits.

How soon can I close on a property?

Turnkey properties are available now — many can close within the 1031 exchange timelines.

Final Takeaway: A Broader Look at Memphis Real Estate

The Memphis real estate market is far more dynamic than many investors realize. The key is to look past generalizations and focus on high-performing areas — the kind that offer long-term demand, predictable returns, and a quality experience for both tenants and owners.

In 2025, Memphis suburbs continue to outperform expectations. If you’re looking for stable income, long-term growth, and investment-friendly policies, it’s time to take a closer look at the greater Memphis MSA.

Need help exploring your options? Meridian Pacific Properties offers fully managed investment opportunities in the region’s strongest submarkets. Contact our real estate investment experts today.

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.