Pending

Pending

4 Bedrooms

4 Bedrooms  2.5 Baths

2.5 Baths  2,300 S.F.

2,300 S.F. 0.24 Acres

0.24 AcresBuy this property for $363,900 and earn $2,175 per month in estimated rent.

"*" indicates required fields

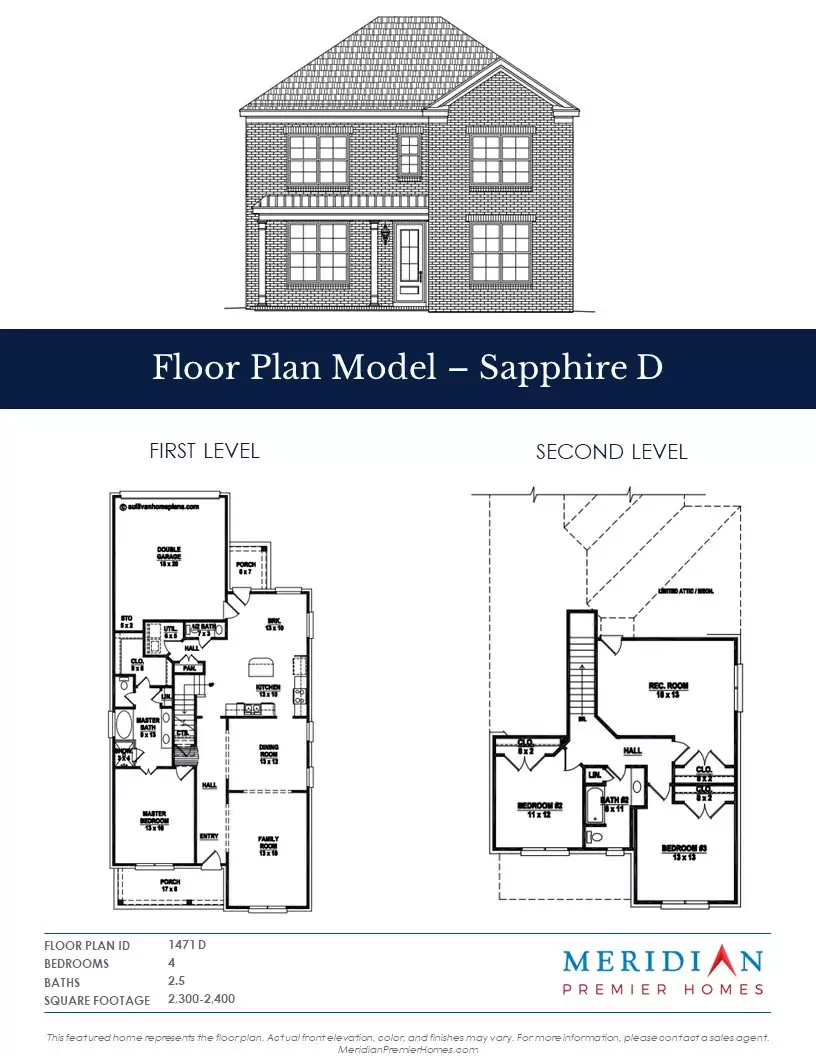

This featured home represents the floor plan. Actual front elevation, color, and finishes may vary. For more information, please contact a sales agent.

The Sapphire welcomes a return to tradition with its combination of intentionally designed indoor and outdoor spaces. Hallmarks of the plan are a rear-load garage and an inviting front patio, which is the perfect spot for relaxing in your favorite wooden rocker or getting caught up with a neighbor over a refreshing glass of lemonade on a warm summer evening. Inside the home, you’ll find a calming color palette. The generously sized family room flows into a formal dining room/library/home office, which connects to a modern chef's kitchen at the back of the home. Bathed in natural light, the kitchen features Shaker cabinets, granite countertops, stainless-steel appliances, a center island, and an eat-in area, as well as a door leading to the back patio. Away from the activity of the kitchen, you’ll discover a private primary suite and elegant ensuite bathroom with soaking tub and dual vanities. A laundry room and half bathroom complete the main level. Upstairs, there are three additional bedrooms and one full bathroom. If you’re a homebuyer who craves defined yet flexible spaces, the Sapphire awaits your personal touches.

| 430 Azalea Drive, Somerville, TN 38068Learn more at meridianpacificproperties.com |

|---|

|

Buy this property for $363,900 and earn

4 Bedrooms  2.5 Baths

2,300 Approximate S.F.

Floor Plan Model - Sapphire

2 Levels

Lot 140 is

0.24 Acres

Built in 2023

2 Garage Spaces |

| ABOUT THE PROPERTYThe Sapphire welcomes a return to tradition with its combination of intentionally designed indoor and outdoor spaces. Hallmarks of the plan are a rear-load garage and an inviting front patio, which is the perfect spot for relaxing in your favorite wooden rocker or getting caught up with a neighbor over a refreshing glass of lemonade on a warm summer evening. Inside the home, you’ll find a calming color palette. The generously sized family room flows into a formal dining room/library/home office, which connects to a modern chef's kitchen at the back of the home. Bathed in natural light, the kitchen... INVESTOR INCENTIVESContact Brian Conlon to learn about investor incentives not advertised online. Call Brian at (760) 798-3095 or email info@meridianpac.com. |

ABOUT THE CALCULATIONSThe calculations and data presented herein are deemed to be accurate, but accuracy is not guaranteed. The projected pro forma returns on investment are intended for the purpose of illustrative projections to facilitate analysis and are not guaranteed by Meridian Pacific Properties, Inc. or its affiliates and subsidiaries. The information provided herein is not intended to replace or serve as a substitute for any legal,real estate, tax, or other professional advice, consultation or service. The prospective buyer should consult with a professional in the respective legal, tax, accounting, real estate, or other professional area before making any decisions or entering into any contracts pertaining to the property or properties described herein. | CONTACT

|

This featured home represents the floor plan. Actual front elevation, color, and finishes may vary. For more information, please contact a sales agent. |

| 430 Azalea Drive, Somerville, TN 38068Learn more at meridianpacificproperties.com |

|---|

|

FLOOR PLAN

|

NEW CONSTRUCTION IN Hedge RoseWelcome to Hedge Rose -- one of Meridian's newest communities Northeast of Memphis! With its fresh air and scenic vistas, Hedge Rose is the epitome of country living. Located in the charming Southern city of Somerville, Tennessee, this established community offers a blend of thoughtfully designed floor plans and elevations built to Meridian’s high standards of excellence. You’ll find the space to host a big backyard celebration or an intimate indoor gathering. Best of all, Hedge Rose is within minutes of Oakland's shopping and restaurants, less than an hour from the amenities of downtown Memphis, and a 25-minute commute to...

| CONTACT

| ||||||||

This featured home represents the floor plan. Actual front elevation, color, and finishes may vary. For more information, please contact a sales agent. |

About the calculations

The calculations and data presented herein are deemed to be accurate, but accuracy is not guaranteed. The projected proforma returns on investment are intended for the purpose of illustrative projections to facilitate analysis and are not guaranteed by Meridian Pacific Properties, Inc. or its affiliates and subsidiaries. The information provided herein is not intended to replace or serve as a substitute for any legal,real estate, tax, or other professional advice, consultation or service. The prospective buyer should consult with a professional in the respective legal, tax, accounting, real estate, or other professional area before making any decisions or entering into any contracts pertaining to the property or properties described herein.

Monthly Rent *

Represents the middle point of an expected rent range. We expect the rent to be within $50 of the estimated rent. Meridian helps to protect the rental income for our investors through our rent warranty program. Please call Meridian Pacific Properties directly for more information.

"*" indicates required fields