Pending

Pending

4 Bedrooms

4 Bedrooms  2.5 Baths

2.5 Baths  2,000 S.F.

2,000 S.F.  0.36 Acres

0.36 Acres Buy this property for $379,000 and earn $2,250 per month in estimated rent.

"*" indicates required fields

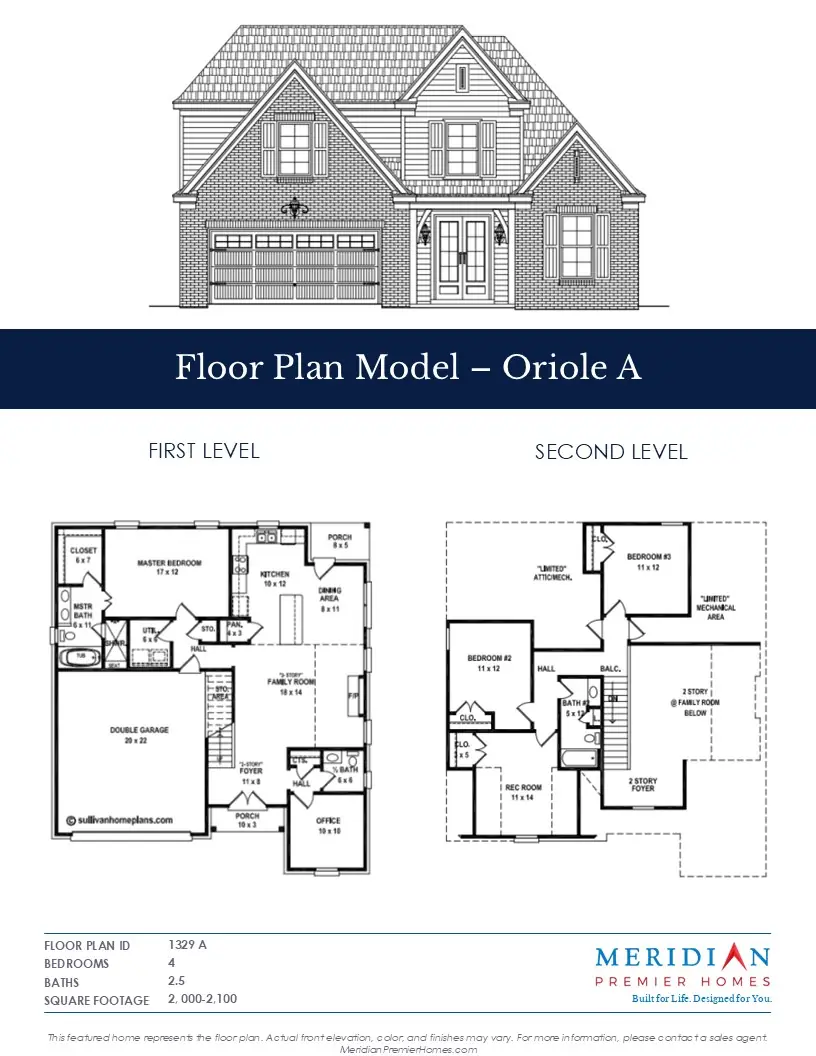

This featured home represents the floor plan. Actual front elevation, color, and finishes may vary. For more information, please contact a sales agent.

The Oriole is a popular, contemporary floor plan that combines an attractive exterior with the design practicality and comfort sought by today’s families. When you pull up, one of the first things you’ll notice is the plan’s inviting front porch and entryway. Off the foyer is a flex space that may serve as a playroom, office, or home gym. Further inside you’ll discover an impressive two-story great room that evokes feelings of warmth and grandeur. The built-in fireplace and floating mantle help set the mood on our chilly Memphis nights. The adjoining well-appointed kitchen is the hub of the home. It features granite countertops, Shaker-style cabinetry, stainless-steel appliances, an island, pantry closet, and eat-in area. Down the hall, and tucked away from the home’s main-living area, is your primary suite with views of your backyard. The ensuite bathroom includes a separate tub and tiled shower, double vanity, and walk-in closet. As you ascend the stairs, take in views of the great room. Once upstairs, you’ll find three more bedrooms and a full bathroom with a linen closet. The plan also comes with a concrete patio for outdoor entertaining.

|

30 Hughetta Street North, Oakland, TN 38060Learn more at meridianpacificproperties.com |

|---|

|

Buy this property for $379,000 and earn

4 Bedrooms

2.5 Baths

2,000 Approximate S.F.

Floor Plan Model - Oriole

2 Levels

Lot 3 is

0.36 Acres

Built in 2024

2 Garage Spaces

|

|

ABOUT THE PROPERTYThe Oriole is a popular, contemporary floor plan that combines an attractive exterior with the design practicality and comfort sought by today’s families. When you pull up, one of the first things you’ll notice is the plan’s inviting front porch and entryway. Off the foyer is a flex space that may serve as a playroom, office, or home gym. Further inside you’ll discover an impressive two-story great room that evokes feelings of warmth and grandeur. The built-in fireplace and floating mantle help set the mood on our chilly Memphis nights. The adjoining well-appointed kitchen is the hub of the home.... INVESTOR INCENTIVESContact Brian Conlon to learn about investor incentives not advertised online. Call Brian at (760) 798-3095 or email [email protected]. |

ABOUT THE CALCULATIONSThe calculations and data presented herein are deemed to be accurate, but accuracy is not guaranteed. The projected pro forma returns on investment are intended for the purpose of illustrative projections to facilitate analysis and are not guaranteed by Meridian Pacific Properties, Inc. or its affiliates and subsidiaries. The information provided herein is not intended to replace or serve as a substitute for any legal,real estate, tax, or other professional advice, consultation or service. The prospective buyer should consult with a professional in the respective legal, tax, accounting, real estate, or other professional area before making any decisions or entering into any contracts pertaining to the property or properties described herein. |

CONTACT

|

|

This featured home represents the floor plan. Actual front elevation, color, and finishes may vary. For more information, please contact a sales agent. |

|

30 Hughetta Street North, Oakland, TN 38060Learn more at meridianpacificproperties.com |

|---|

|

FLOOR PLAN

|

|

|

|

NEW CONSTRUCTION IN Carrington EstatesDiscover Carrington Estates, Meridian’s newest community in Oakland, Tennessee. This charming enclave of 44 homesites marries the tranquility of rural-suburban living with easy access to amenities like shopping centers, dining options, medical services, and top-tier schools. Each home in Carrington Estates is a testament to Meridian's commitment to excellence and style, offering sophisticated designs, sought-after finishes, and generously sized floor plans ranging from 2,000 to 3,300 square feet. Outdoor enthusiasts will enjoy the community’s well-maintained common areas, which support an active lifestyle while fostering connection with nature and neighbors. Carrington Estates isn’t just a place to live – it's a...

|

CONTACT

|

||||||||

|

This featured home represents the floor plan. Actual front elevation, color, and finishes may vary. For more information, please contact a sales agent. |

About the calculations

The calculations and data presented herein are deemed to be accurate, but accuracy is not guaranteed. The projected proforma returns on investment are intended for the purpose of illustrative projections to facilitate analysis and are not guaranteed by Meridian Pacific Properties, Inc. or its affiliates and subsidiaries. The information provided herein is not intended to replace or serve as a substitute for any legal,real estate, tax, or other professional advice, consultation or service. The prospective buyer should consult with a professional in the respective legal, tax, accounting, real estate, or other professional area before making any decisions or entering into any contracts pertaining to the property or properties described herein.

Monthly Rent *

Represents the middle point of an expected rent range. We expect the rent to be within $50 of the estimated rent. Meridian helps to protect the rental income for our investors through our rent warranty program. Please call Meridian Pacific Properties directly for more information.

"*" indicates required fields