Vacancies and Repairs are Inevitable

Investing in real estate is one of the most reliable ways to build wealth, but it’s not without its challenges. One of the most overlooked aspects of rental property ownership is the importance of maintaining a reserve fund for maintenance and unexpected expenses. While a brand-new home might not require repairs for several years, maintenance costs are inevitable. Instead of being caught off guard, successful investors anticipate and prepare for these expenses.

When we put together pro forma estimates at Meridian Pacific Properties, we include vacancy and maintenance expenses in our underwriting. However, these are not exact budgets. Rather, they serve as guidelines to account for the natural fluctuations in maintenance and vacancy costs.

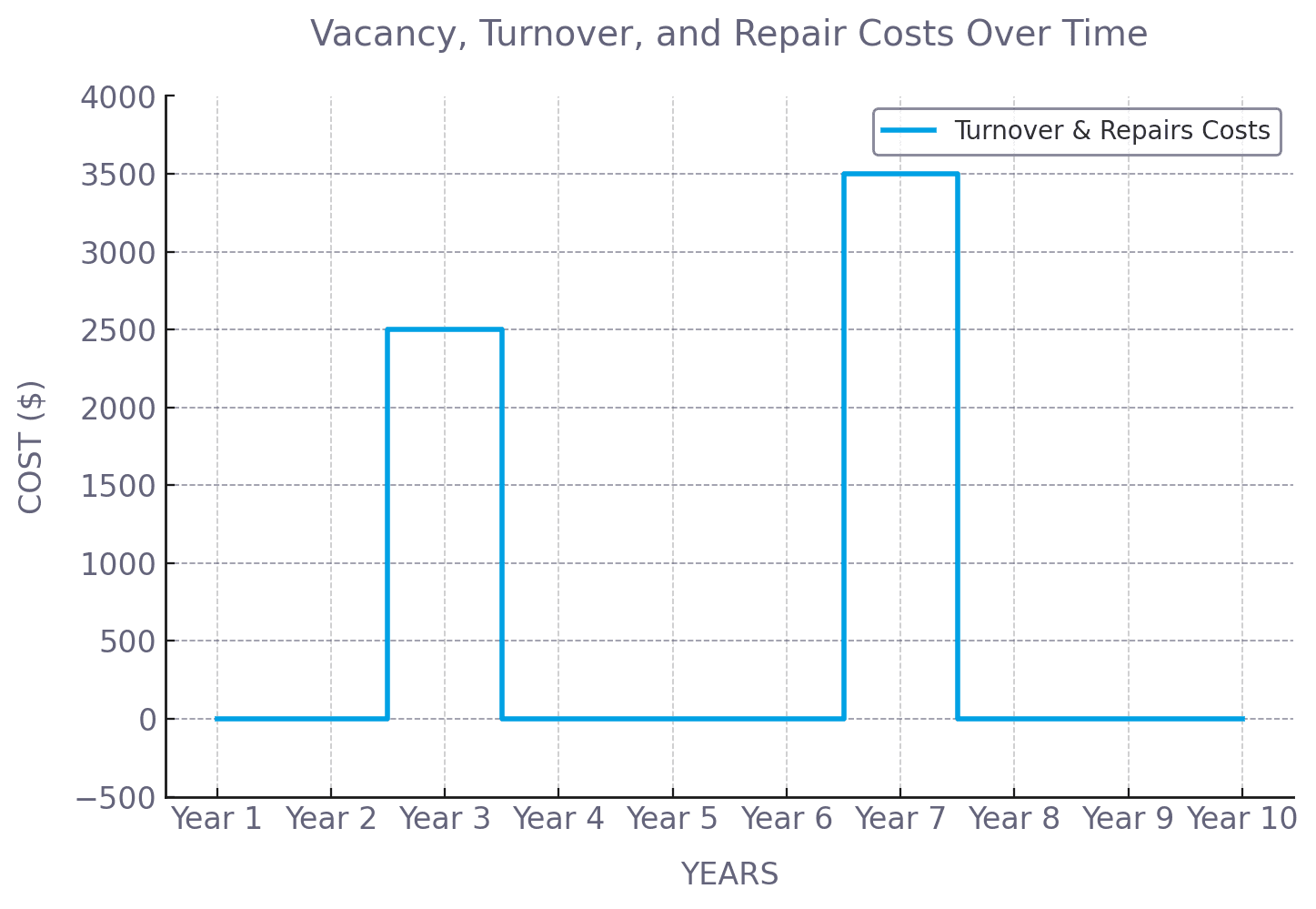

“Instead of assuming a steady ‘5% maintenance and vacancy cost per year,’ it’s more realistic to expect some years with little to no costs and others where expenses are significantly higher,” says Brian Conlon, Director of Business Development at Meridian Pacific Properties.

For example, you may go three years without a vacancy and minimal costs. Then, when a tenant does leave, you could have a 30-45 day period with no rental income, and have to pay the turn cost and lease up fee to get new tenants.

This variability can be shocking for investors who see higher monthly cash flow than projected in the early years, only to be hit with significant expenses later. If you don’t plan for these fluctuations, you might find yourself struggling to cover necessary costs when they arise.

Here is a chart showing how an investor might experience expenses over the first decade of homeownership. There are years with expenses and years with significantly higher expenses.

The Importance of a Reserve Fund

A reserve fund acts as a financial safety net, ensuring that when maintenance issues do arise, you have the funds readily available. Here are some key reasons why keeping a reserve fund is critical for real estate investors:

1. Maintenance Costs are Inevitable

Even in new construction homes, components wear out over time. Roofs, appliances, plumbing, and HVAC systems all have lifespans. A reserve fund allows you to address these issues promptly without dipping into your personal savings or monthly cash flow. On our new homes, the maintenance is very low and will mostly be related to tenant turn costs like new paint or carpet.

2. Vacancies are Inevitable

Even the best properties will have vacancies. Every few years you will need to be prepared to pay the costs associated with a tenant moving out and new tenants moving in. During this time you may not have any rental income and will have to pay a lease up fee to the property management company to find a new tenant. This is typically equal to about one month’s rent.

3. Consistent Tenant Experience

A well-maintained property leads to happier tenants, lower turnover, and reduced vacancy costs. We believe in keeping our properties well cared for and creating a great experience for each new tenant.

4. Market Cycles and Economic Downturns

During economic downturns or slow rental markets, having a reserve fund can help investors navigate periods of higher vacancy rates or unexpected expenses without financial distress.

How Much Should You Set Aside?

While every investor’s situation is different, a general rule of thumb is to set aside 10% of your rental income annually for maintenance and repairs. Some investors prefer to save a set dollar amount per property per year, such as $2500, depending on the age and condition of the home.

“At Meridian, we recommend setting aside two months rent in a reserve,” says Conlon. “You probably will not need it for your first couple of years, and then, when you inevitable do have a vacancy, you are financially prepared for the turnover costs.”

According to the U.S. Census Bureau, the average vacancy rate for rental properties hovers around 6.4%. Investors should anticipate periodic vacancies and set aside funds to cover both maintenance and potential lost income during these times.

For new construction homes, maintenance costs tend to be lower in the first ten years, but that doesn’t mean you should ignore saving for future expenses. Consider building your reserve fund early so that when major expenses eventually arise, you’re fully prepared.

Understanding Vacancy and Lease-Up Costs

One of the advantages of investing with Meridian Pacific Properties is that we make the first few years of ownership as smooth as possible. We provide rent from day one, ensuring investors see immediate cash flow. Additionally, most lease agreements span 18-24 months, and we cover the lease-up fee—the cost of preparing a rental for new tenants—which is typically equivalent to one month’s rent.

For the first couple of years, investors enjoy steady rental income with minimal disruptions. However, after about two years, a new tenant will likely be needed. At that point, investors should anticipate a vacancy period of 30-45 days, along with the lease-up fee. These are standard occurrences in rental investing and should be planned for in advance.

Many investors are caught off guard when they experience their first vacancy and associated costs, leading to frustration with property management. However, this isn’t an unexpected setback—it’s part of the normal investment cycle. Meridian Pacific Properties’ approach simply makes the early years more predictable, helping investors build cash flow before they encounter these natural rental property expenses. By setting aside reserves for vacancy periods and lease-up costs, investors can ensure a smooth and financially stable ownership experience.

Using the Cash Flow Calculator to Plan for Maintenance Costs

Meridian Pacific Properties provides investors with a powerful Cash Flow Calculator, allowing you to instantly model out 10-year performance estimates on any investment home. In the Advanced section, you can customize vacancy and maintenance assumptions to understand how different scenarios may impact cash flow over time.

While pro forma estimates help investors understand expected returns, it’s essential to remember that real estate investing involves an ebb and flow. Maintenance and vacancy expenses do not occur at a fixed percentage each year but fluctuate based on property condition, market conditions, and unexpected repairs.

By planning for these fluctuations and maintaining a dedicated reserve fund, investors can confidently manage their properties and maximize their long-term returns.

Plan Ahead for Inevitable Costs

Real estate investment is a long-term wealth-building strategy, but only if managed correctly. Having a reserve fund is not an option—it’s a necessity. Don’t let early years of positive cash flow lull you into a false sense of security. It’s not if maintenance expenses will arise, but when.

Smart investors plan for these inevitable costs, ensuring that they can handle repairs quickly, keep tenants satisfied, and protect the value of their investment properties. At Meridian Pacific Properties, we encourage our investors to take a proactive approach by modeling different financial scenarios using our Cash Flow Calculator and maintaining a well-funded reserve for the long-term success of their real estate portfolios.

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.