The difference in returns between an interest rate at 5.25 percent and 3.375 percent is important to understand. We have highlighted in our newsletters the fact that interest rates are at an all-time low, now we want to attach numbers to this to show the improvement in return. For the more analytical folks, this may inspire people to action.

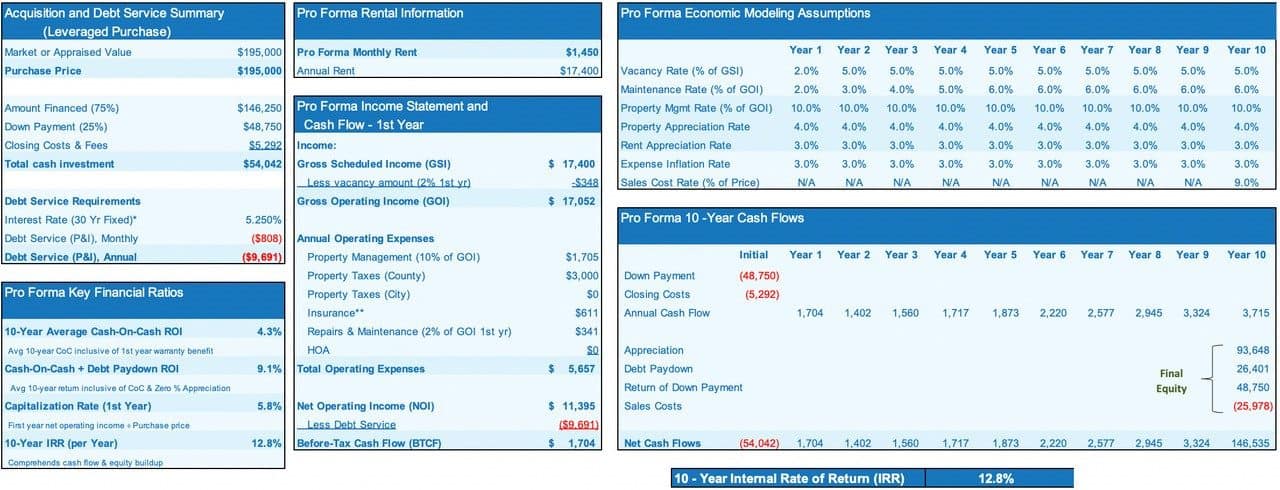

The first image shows the return at an interest rate of 5.25 percent. The key metrics are in the bottom-left section of the attachment. For example, you see a 4.3 percent 10-year average cash-on-cash Return of Investment (ROI).

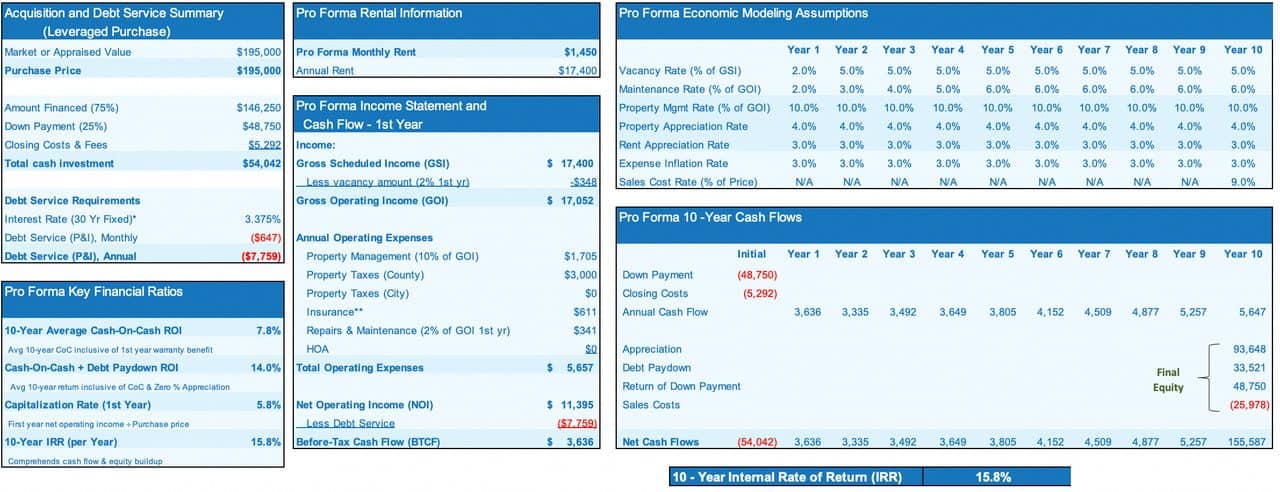

The second image shows the returns at an interest rate of 3.375 percent. You can see in the bottom left corner, a 7.8 percent 10-year average cash-on-cash ROI.

The net impact of going from an interest rate of 5.25 percent to 3.375 percent is giving the investor over an 80 percent improvement – about 81.39 percent to be accurate – in cash flow on the return. This is, in essence, a way to “give yourself a raise” on the returns of your home.

This is a pretty staggering disparity and can turn an under-performing investment into a cash cow.

Want to do some more math on your own investments? Reach out to us directly and we’ll talk numbers.

If you want to learn more, learn about our New Portfolio Performance Report designed to show you how your real estate portfolio has performed over time and how you can improve on your investments.

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.