California continues to pass new housing laws aimed at protecting tenants — but for homeowners and small landlords, these changes bring rising costs and serious legal risk.

This article breaks down how recent legislation has reshaped the rental landscape — and what may be coming next. I’ll share what I’ve learned from a real estate attorney and what I wish I knew before investing in California. If you own property in the state and aren’t 100% sure of your legal responsibilities, this is a must-read.

Let’s start with why California is such a challenging place to be a landlord.

It all started with good intentions. Lawmakers wanted to address rising housing costs and protect vulnerable renters. But as more agencies got involved—across city, county, and state levels—California became the most over-regulated real estate market in the country. Today, the state has more housing laws, tenant protections, and enforcement mechanisms than any other.

Unfortunately, the result hasn’t been more affordability—it’s been the opposite.

According to the California Legislative Analyst’s Office, California’s high home prices are primarily driven by a severe shortage of housing, made worse by restrictive zoning laws, CEQA delays, and regulatory barriers to new construction. Investors and developers have been pushed out or forced to raise rents to manage rising costs, legal exposure, and property taxes. Meanwhile, the Urban Reform Institute ranks California among the least affordable housing markets in the world, with rent and purchase prices wildly outpacing income.

At the same time, laws meant to protect tenants—like SB 567, AB 1418, and a wave of new restrictions in 2025—have made it extremely difficult to manage properties, remove problem tenants, or adjust pricing to reflect market conditions. Owners now face complex timelines, lawsuit risks, and fines that can exceed $10,000 per violation.

These layers of bureaucracy have pushed many small landlords to sell—not because they don’t care about housing, but because the risk of ownership has become too high. And as those properties leave the rental pool or are bought by institutional buyers, affordability continues to slip.

In short, overregulation drove up the cost of housing, while trying to solve affordability. And California homeowners are stuck in the middle.

⚠️ New Legislation for California Landlords

In an effort to protect tenants and promote affordability, California lawmakers have created a patchwork of legislation that’s increasingly difficult for property owners to navigate. While well-intentioned, many of these laws have introduced significant financial risk for homeowners and small landlords—particularly those managing their own investment properties without full-time legal or property management support.

The California Tenant Protection Act and its many amendments are especially burdensome. They’re complex, frequently updated, and inconsistently enforced across municipalities. This creates a high-stakes environment where even minor mistakes—like incorrect notice formatting or missed deadlines—can result in legal exposure or steep fines.

In conversations with a California real estate attorney, I learned that the greatest risk isn’t intentional misconduct—it’s honest mistakes. Owners who fail to comply with a single notice requirement or who misinterpret a new law can quickly face thousands of dollars in penalties. In several cases, the legal costs alone forced property owners to sell just to cover the damages. And this trend is growing. Each new legislative session brings tighter rules, more tenant protections, and increased liability for landlords.

New Laws Effective in 2024 and 2025

AB 1418 (Effective January 1, 2024): Crime-Free Housing Restrictions

Targets discriminatory “crime-free housing” programs used by some cities and counties.

- Bans local governments from requiring landlords to evict tenants for suspected criminal activity

- Prohibits eviction based solely on prior convictions (including household members)

- Prevents penalizing landlords for repeated 911 or police calls from a tenant’s address

- Eliminates mandatory nuisance ordinances that conflict with state tenant protections

Risk to owners: You may not be able to remove tenants even after repeat law enforcement incidents unless you can prove a current lease violation.

SB 567 (Effective April 1, 2024): Tighter “No-Fault” Evictions

Amends the California Tenant Protection Act to make owner move-in and remodel evictions far more difficult.

- Landlords must move in within 90 days of the tenant vacating

- Must occupy the property as their primary residence for at least 12 consecutive months

- Eviction notices must clearly identify the person moving in and their relationship to the owner

- If these terms are violated, the tenant has a right to return or sue for damages

Bottom Line: Homeowners can no longer use future move-in plans as a legal basis for eviction unless they follow strict occupancy timelines and documentation.

AB 2747 (Effective April 1, 2025): Rent Reporting

Designed to help tenants build credit by rewarding on-time rent payments.

- Landlords must offer tenants the option to report rent payments to credit bureaus

- Must notify tenants at the start of the lease and annually thereafter

- Applies to all new or renewed leases on or after April 1, 2025

- May charge a processing fee of up to $10/month for providing the reporting service

Note: This requires formal written offers and likely changes to lease templates and annual notices.

SB 611 (Effective April 1, 2025): Bans Junk Fees

Cracks down on hidden or excessive administrative charges in residential leases.

- Landlords may not charge tenants for standard notices, such as:

- Notices to pay rent or quit

- Notices of lease violations

- Lease renewal notices

- Also bans fees that are not disclosed upfront in the lease agreement

- Intended to increase transparency and stop predatory fee practices

Implication: If you’ve built fees into your lease as a deterrent or administrative charge, you may need to revise your rental agreements.

AB 2801 (Effective July 1, 2025): Security Deposit Photo Documentation

Adds formal documentation requirements for withholding security deposits.

- Landlords must take clear, timestamped photos of the unit:

- At move-in

- At move-out

- After cleaning or repairs before deducting from the deposit

- Photos must be shared with the tenant if any deductions are made

- Applies to all new leases starting July 1, 2025

- Failure to comply may prevent deposit deductions and expose you to penalties

Takeaway: Visual documentation is no longer optional. Landlords must follow detailed proof standards or risk losing the ability to retain any portion of the deposit.

SB 436 (Pending)

Would amend state eviction law to offer more time before a landlord can begin eviction proceedings.

- Increases the minimum notice period to 14 days (from 3 days) for nonpayment of rent

- Would apply to most residential tenancies statewide

- Still under consideration by the legislature in 2025

Impact if Passed: Significantly slows down the eviction process for missed rent—landlords would wait nearly two weeks before initiating legal action.

California Is Trending Towards Tenant Protections

These new laws reflect a fundamental shift in how California regulates rental housing. While they aim to increase tenant protections, they also create more administrative work, legal exposure, and financial liability for property owners.

If you’re managing property in California, now is the time to audit your leases, update your documentation procedures, and consider legal or property management support. The rules are no longer intuitive—and the cost of non-compliance is simply too high.

How high are the fines for violations in California?

Even small clerical errors—like failing to properly document move-in photos—can now block deposit deductions or expose you to legal claims. Landlords face growing liability under California law, including:

| Violation Type | Law/Statute | Penalty or Exposure |

|---|---|---|

| Improper “no-fault” eviction | SB 567 (2024) | Up to 3× actual damages, legal fees, and tenant right of return |

| Failure to provide move-in/move-out photos | AB 2801 (Effective 7/1/25) | Forfeits right to deduct from deposit; up to 2× withheld amount in penalties |

| Eviction based on criminal history or police calls | AB 1418 (2024) | Lawsuit risk; invalid eviction; potential civil penalties |

| Not offering rent reporting to tenants | AB 2747 (Effective 4/1/25) | Civil claim risk; lease non-compliance if tenant not properly notified |

| Charging undisclosed or unlawful admin fees | SB 611 (Effective 4/1/25) | Must refund fees; exposure to statutory penalties for deceptive practices |

| Raising rent over 10% during declared emergency | CA Penal Code § 396 | Civil fines of $10,000–$50,000 per violation |

| Bad-faith eviction or retaliation | Civil Code § 1942.5 | Up to 3× actual damages + legal fees |

| Habitability violations (e.g., unresolved repairs) | Health & Safety Code | Lawsuits; repair-and-deduct actions; local enforcement fines and penalties |

What To Do If You Own California Real Estate

If you want to own in California, more power to you. Just be educated.

- Review your leases with a qualified attorney

- Document everything, especially repairs, inspections, and tenant communications

- Consider professional property management to reduce risk

- Stay up to date—housing laws are changing quickly, and non-compliance is expensive

California Landlord Compliance Checklist

This has been a lot of information to digest. Here’s a simple checklist you can download and use to ensure you are following the latest regulations.

Download The Checklist 👇👇

CA Landlord Legislation Checklist (2024-2025)

California Owners Are Moving Investments Out-of-State

With tighter laws, rising insurance costs, and growing liability, many California landlords are choosing to sell or exchange their properties for investment real estate in more landlord-friendly states.

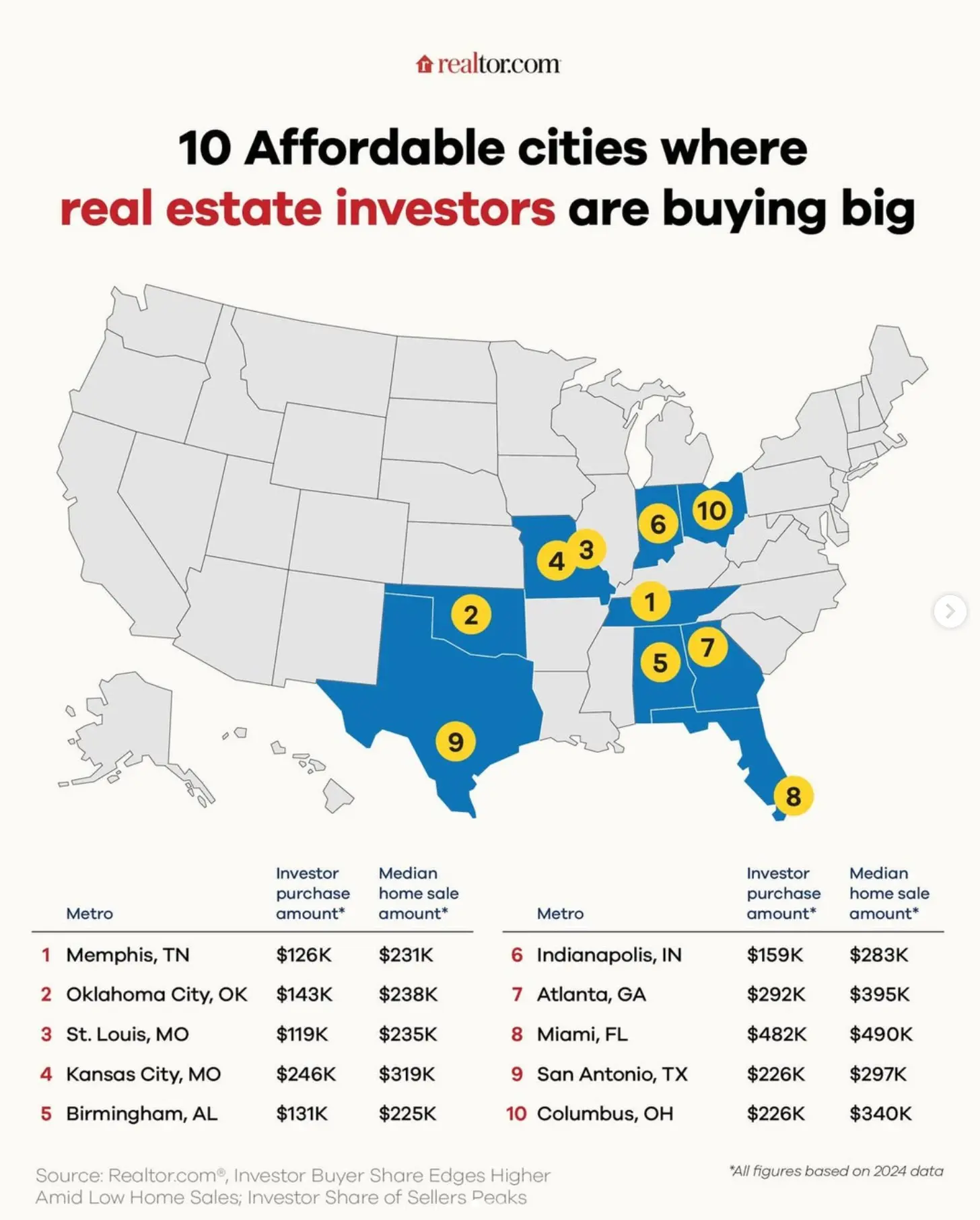

For some, a 1031 exchange into a market like Tennessee, Mississippi, Texas, or Florida offers not just better returns, but peace of mind.

If you’re weighing your options, now’s the time to explore alternatives—and protect your investment.

📞 Talk to a Real Estate Exchange Specialist

We invest in Memphis. Where it still makes sense.

At Meridian, we don’t just build homes — we invest in markets that make sense for long-term ownership.

One of the most important factors we use when evaluating any real estate market is the legal environment. Is the state landlord-friendly? Are housing laws predictable and fair? Is it possible to manage properties efficiently without constant exposure to fines and red tape?

California, unfortunately, fails on nearly every front. But Memphis — and the greater Memphis metro area — stands in sharp contrast.

A More Landlord-Friendly Legal Environment

Tennessee consistently ranks among the most landlord-friendly states in the country. That’s not just opinion — it’s backed by how the laws are written and enforced.

- Eviction timelines are clearly defined and significantly faster than in California

- Rent control is prohibited by state law

- There are no mandatory tenant reporting or photo documentation rules

- Local governments don’t add layers of compliance beyond state law

This allows investors to operate with clarity and consistency, which translates to lower costs, fewer surprises, and better cash flow.

Lower Property Taxes and Ownership Costs

Owning real estate in Memphis costs less — plain and simple.

- Property taxes in Tennessee are substantially lower than in California

- There is no state income tax, so rental income is more favorable

- Insurance costs are generally lower, with fewer wildfire or natural disaster exclusions

When you eliminate the administrative burden and high costs of compliance, more of your rental income goes where it should: to your bottom line.

Strong Returns and More Buying Power

Affordability in Memphis is dramatically better than in California. The median home price in the submarkets where we build is often less than 40% of what you’d pay in a coastal county.

That means you can:

- Buy multiple cash-flowing properties instead of one over-leveraged home

- Diversify your portfolio across different communities or tenants

- Grow your equity faster through appreciation and debt paydown

Suburban Growth and Professional Management

Our investment properties are located in high-demand suburban communities like Oakland, Olive Branch, and Horn Lake — areas seeing population growth, school expansion, new infrastructure, and job creation. We also provide professional property management and an optional rent warranty program, giving investors peace of mind no matter where they live.

CA vs TN Landlord Environment Comparison Table

If you’re weighing your options, it helps to see how the legal environment, affordability, and ownership experience compare across states. The table below outlines some of the key differences between California and Tennessee (specifically the Memphis metro area), based on current legislation and investment conditions.

| Category | California | Tennessee (Memphis Metro) |

|---|---|---|

| Rent Control | Widespread and expanding | Prohibited by state law |

| Eviction Timelines | 30–90+ days with legal risk | 14–21 days, clearly defined |

| Late Rent Grace Periods | Potential extension to 14 days (SB 436) | Typically 7–14 days, no pending extensions |

| Move-In Photo Requirements | Required (AB 2801, July 2025) | Not required |

| Mandatory Rent Reporting | Required offer (AB 2747, April 2025) | Not required |

| Junk Fee Ban | Banned (SB 611, April 2025) | No state-level restrictions |

| Local Compliance Layers | Extensive (state + city + county) | State law only |

| Affordability Index | 17% can afford median-priced home | >60% in many Memphis suburbs |

| Median Home Price | $846,830 (CA statewide, Q1 2025) | ~$250,000–$350,000 in MPP submarkets |

| Insurance & Property Taxes | High premiums, rising wildfire exclusions | Lower costs, fewer disaster risks |

| Legal Complexity | High – frequent law changes and lawsuits | Simple – clear landlord-tenant statutes |

California’s housing laws are evolving rapidly — and not always in ways that support small property owners. With new requirements arriving every legislative session, landlords face increasing financial exposure, legal uncertainty, and operational burdens. For many, the risk of remaining in the market now outweighs the potential reward.

By contrast, markets like Memphis offer a more stable environment where laws are clear, costs are manageable, and rental property ownership remains accessible. If you’re exploring where to grow or protect your portfolio, it’s worth looking beyond California — not just for affordability, but for peace of mind.

California Tenant-Landlord Real Estate Attorneys

If you would like a referral for an excellent attorney to answer your questions and protect your assets, please reach out. You can call or text me at (901) 300-2260.

Helpful Links

🔎 Search Investment Properties

Sources

- Senate Bill 567 (No-Fault Eviction Reform) – Bill Text

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202320240SB567 - California Apartment Association – Summary of SB 567

https://caanet.org/governor-signs-bill-revising-states-no-fault-eviction-requirements/ - Assembly Bill 1418 (Crime-Free Housing Ban) – Bill Text

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202320240AB1418 - California Apartment Association – Summary of AB 1418

https://caanet.org/newsom-signs-legislation-on-crime-free-housing-policies/ - California Department of Housing and Community Development – Landlord/Tenant Resources

https://www.hcd.ca.gov/rental-assistance/tenant-landlord - California Rental Housing Association – Legal and Policy Updates

https://cal-rha.org/public-policy/ - California Legislative Analyst’s Office – “Why Is Housing Expensive in California?”

https://lao.ca.gov/reports/2015/finance/housing-costs/housing-costs.pdf - Urban Reform Institute – “Demographia International Housing Affordability Report (2024)”

https://urbanreforminstitute.org/wp-content/uploads/2024/01/2024-Demographia-International-Housing-Affordability.pdf

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.