1031 Exchanges

1031 Exchange FAQs

WHY DO INVESTORS USE A 1031 EXCHANGE IN REAL ESTATE?

Use of a 1031 exchange enables investors to keep a significantly greater amount of their capital invested and generating returns, since payment of the tax liability is deferred.

A 1031 exchange in real estate is fairly straightforward to accomplish. Section 1031 of the Internal Revenue Code lays out the guidelines that must be followed to execute a 1031 exchange. While there are a number of categories of assets that can be transacted under a 1031 exchange, the information that follows pertains only to real estate investment property.

Investors over the years have turned to Meridian to help them develop a strategy for improving the returns on their investment properties. Meridian can help with a real estate 1031 Exchange in several ways.

- We help our clients to quickly identify and acquire top-quality replacement properties that deliver superior returns on investment.

- Meridian has already performed the due diligence on the city, the neighborhood, and the properties themselves so that the investor does not have to.

- The properties come with all renovations completed, with tenants and experienced property management already in place. Meridian’s replacement properties are already performing when they are sold.

- In most cases we are able to close properties quickly on short notice if necessary, and have access to lenders who finance investment properties.

- Meridian is not a Qualified Intermediary (QI), but works with Qualified Intermediaries like 1031 Exchange Advantage in San Diego, CA.

WHAT IS THE TIMELINE AND WHAT ARE THE KEY DEADLINES IN A 1031 EXCHANGE?

During the identification period, the investor has exactly 45 days from the date his or her relinquished property has sold to identify in writing the replacement property or properties to be purchased. Identification usually consists of an address and/or legal description. There is no extension of the 45 day deadline under any circumstances. This 45 day timeline is step one of the requirements of the 1031 exchange rules.

Identification Period

During the identification period, the investor has exactly 45 days from the date his or her relinquished property has sold to identify in writing the replacement property or properties to be purchased. Identification usually consists of an address and/or legal description. There is no extension of the 45 day deadline under any circumstances. This 45 day timeline is step one of the requirements of the 1031 exchange rules.

EXCHANGE PERIOD

The second stage of the like kind exchange is the exchange period, which is the time frame in which the investor must receive (or close escrow) on the 1031 Exchange replacement property. This period ends at exactly 180 days after the date on which the person receives the relinquished property, or the due date for the person’s tax return for that taxable year in which the acquisition of the relinquished property has occurred, whichever occurs first. In the latter instance, an investor can always file for an extension on his or her tax return, in which case the exchange period would still be 180 days.

Violation of either the identification or the exchange periods will result in the invalidation of the 1031 exchange, and the investor must pay the taxes due on the capital gain. Therefore it is important for the investor to not wait until the last minute to either identify or close escrow on the replacement property to stay within the 1031 tax exchange rules.

HOW DO I KNOW IF A 1031 EXCHANGE IS RIGHT FOR ME?

A 1031 exchange is the act of making a likekind trade of two assets using certain IRS 1031 exchange rules. Under certain conditions, you can defer capital gains tax payments. This applies to different categories of asset exchanges, but one of the most common is real estate transactions.Current 1031 Exchange Information Frequently Asked Questions

If you are considering a 1031 exchange, you probably have quite a few questions. Here are the answers to some of the most important IRS 1031 exchange rules.What type of assets qualify for a like-kind exchange?

Any two properties that are set aside for business or investment use qualify for a 1031 exchange. The assets also are supposed to be equal in nature, character or class. However, the quality of the two pieces of real estate does not matter, and they do not have to be identical. Any two properties that are set aside for business or investment use qualify for a 1031 exchange. The assets also are supposed to be equal in nature, character or class. However, the quality of the two pieces of real estate does not matter, and they do not have to be identical.Who qualifies for a 1031 Exchange?

Usually, business or investment property owners can make a 1031 trade. This includes owners of a sole proprietorship, C Corporation, S Corporation, trust or partnership. Any other taxpaying entity such as a limited liability company also can set up a likekind business or investment property trade.Are there any time limits for making a like-kind exchange?

In order to avoid a capital gain tax, you must identify a potential replacement property with 45 days of selling a relinquished property. The replacement real estate identification must be documented in writing, and this includes a legal description, street address, or distinguishable property name. You also have up to 180 days after the sale of an exchanged property to receive the replacement real estate. Otherwise, you will be subject to capital gain taxes.What types of like-kind exchanges can be made?

According to the LikeKind IRC IRS 1031 exchange rules, you can choose between three types of likekind transactions. IRS documentation further explains the differences between three 1031 exchange structures: simultaneous, deferred and reverse. The simultaneous exchange is the swapping of two properties at the same time. Deferred exchanges allow you to surrender your real estate and later replace it according to IRS 1031 guidelines. A reverse exchange, on the other hand, allows you to acquire a replacement property through a likekind accommodation titleholder. This real estate is then parked for up to 180 days during which time the taxpayer disposes of the relinquished property.What types of like-kind exchanges can be made?

According to the LikeKind IRC IRS 1031 exchange rules, you can choose between three types of likekind transactions. IRS documentation further explains the differences between three 1031 exchange structures: simultaneous, deferred and reverse. The simultaneous exchange is the swapping of two properties at the same time. Deferred exchanges allow you to surrender your real estate and later replace it according to IRS 1031 guidelines. A reverse exchange, on the other hand, allows you to acquire a replacement property through a likekind accommodation titleholder. This real estate is then parked for up to 180 days during which time the taxpayer disposes of the relinquished property.WHAT IS AN EXAMPLE OF A 1031 EXCHANGE?

Meridian has a track record of helping investors identify, analyze and close successfully on 1031 exchange properties which offer:- Stable Returns in Quality Neighborhoods

- Turnkey Investments with Affordable Entry Prices

- Easy Due Diligence with Fast, Non-Competitive Closings

- Professional In-House Property Management

- Capital Reallocation for Increased Investor ROI

- Cash & Mortgage Boot Solutions

RESIDENTIAL 1031 EXCHANGE EXAMPLE

What is a 1031

Exchange?

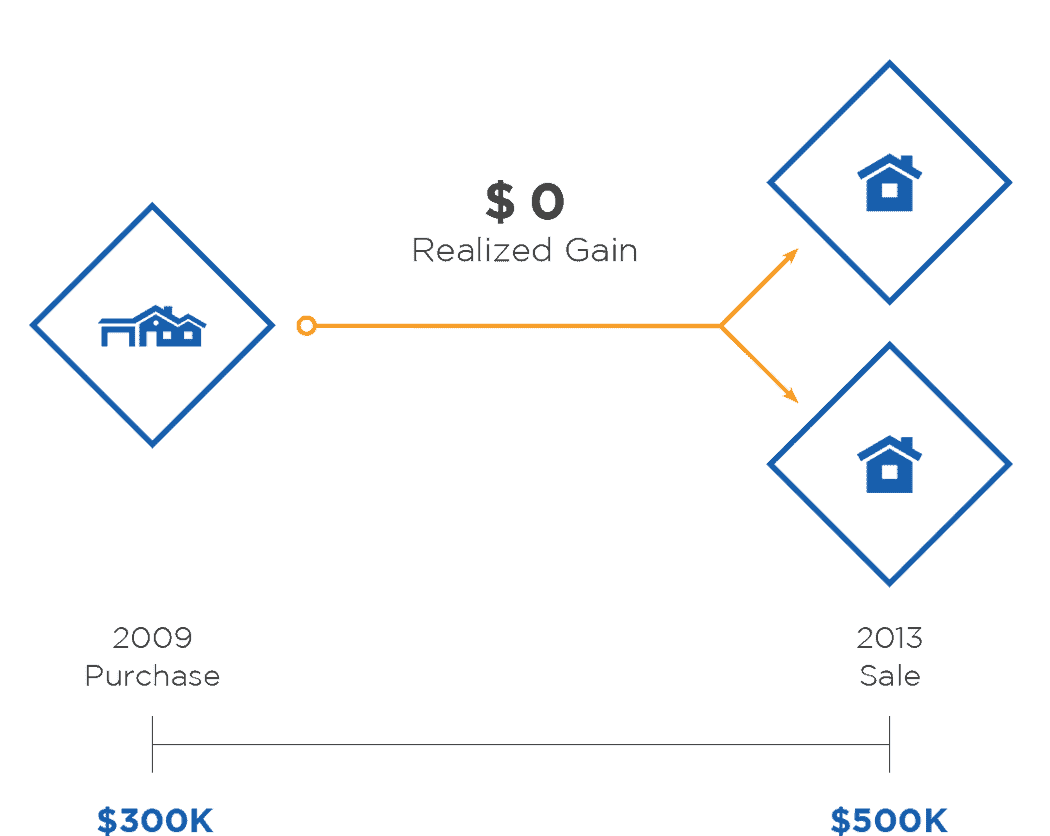

NON-EXCHANGE TREATMENT

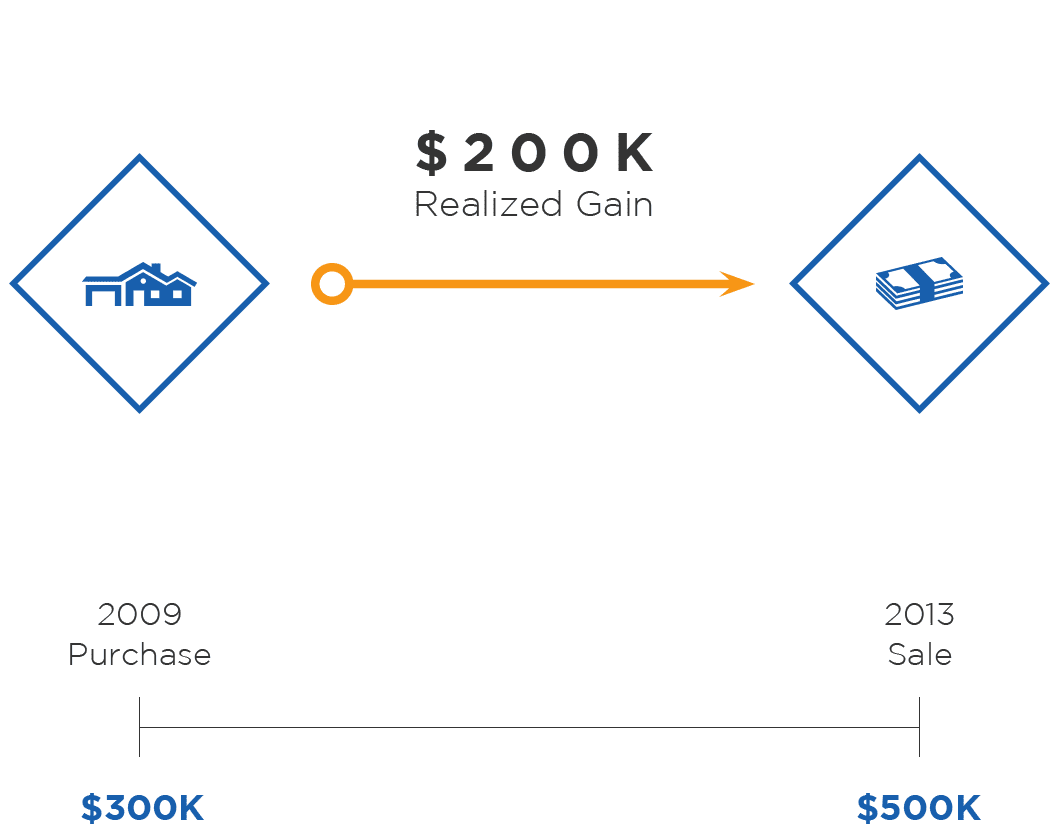

EXCHANGE TREATMENT