Real estate has long been one of the most reliable and rewarding investment vehicles. Among various property types, single-family rental (SFR) homes have emerged as a particularly attractive asset class, offering investors both monthly rental income and long-term appreciation potential. Understanding home price appreciation is crucial for investors who want to build wealth through real estate while making informed decisions about their properties.

This article explores how and why investment properties appreciate, the key factors influencing appreciation in SFR homes, and strategies to maximize returns while ensuring sustainable growth.

Understanding Home Price Appreciation

Home price appreciation refers to the increase in a property’s value over time. It is driven by a combination of market demand, economic factors, inflation, and property improvements. Unlike other investment vehicles that can be volatile, real estate typically appreciates steadily, providing investors with both short-term rental income and long-term equity gains.

Appreciation is measured in two ways:

- Nominal Appreciation: The raw increase in home value over time.

- Real Appreciation: The increase in value after accounting for inflation.

For investors in SFR properties, appreciation is a critical factor in long-term wealth accumulation. As property values rise, owners can benefit from higher equity, increased rental income, and better refinancing options.

The Power of Appreciation in SFR Investments

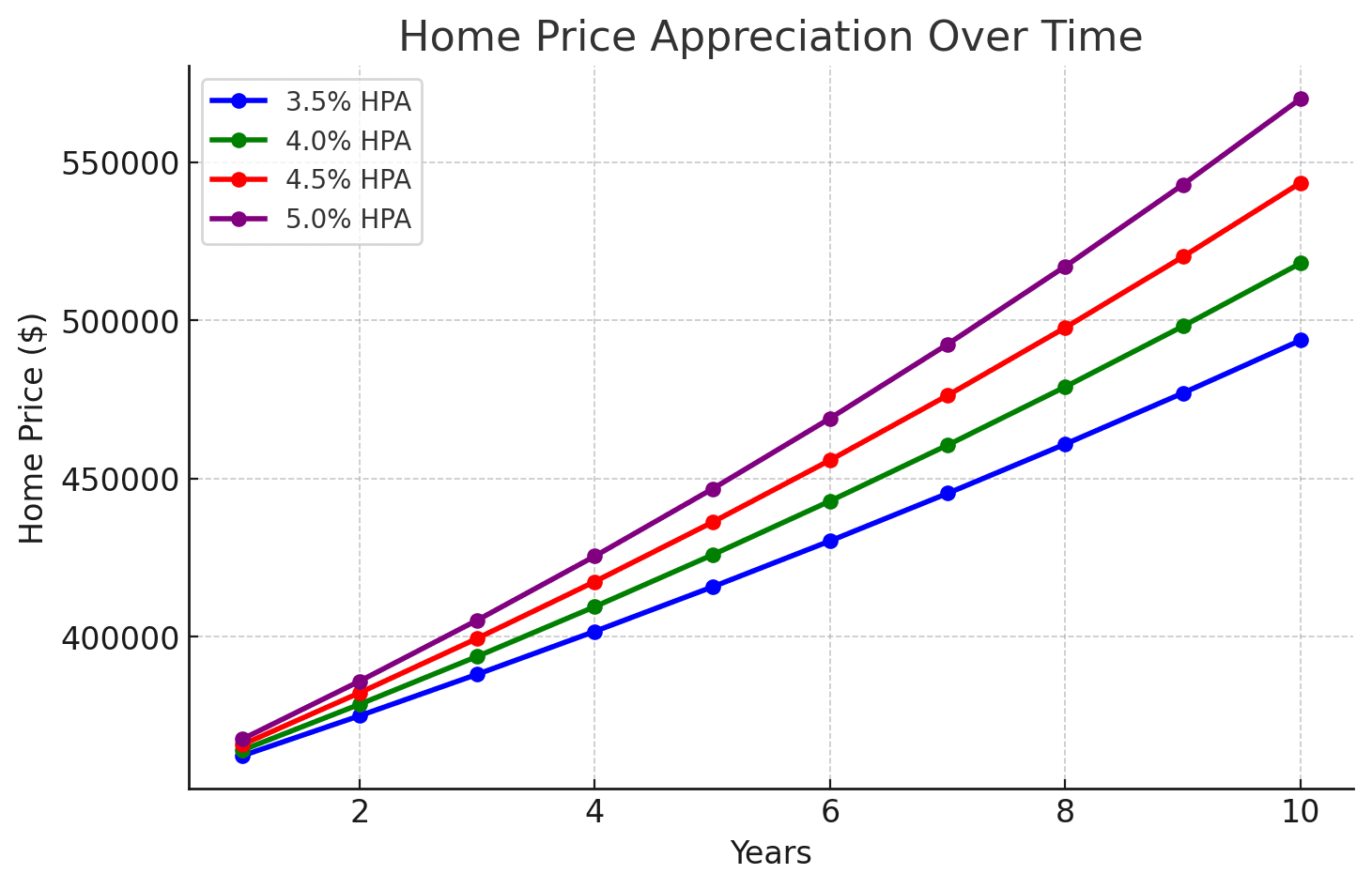

Let’s take an example of a single-family rental home purchased for $350,000 with an annual appreciation rate of 4%. Using the standard home price appreciation formula, we can estimate how the property’s value grows over time. Over 10 years, the home’s value appreciates by more than $168,000, significantly increasing equity for the investor.

At a 5% appreciation rate, a home valued at $350,000 today could exceed $570,000 in 10 years. This represents a total return on investment (ROI) of 62.86%, meaning the property’s value increases by that percentage over the decade. The annualized return, or compound annual growth rate (CAGR), is approximately 5% per year, reflecting the steady appreciation over time. This level of wealth accumulation is significant, especially when combined with consistent rental income, allowing investors to build equity while enjoying cash flow from the property.

| Year | 3.5% HPA | 4.0% HPA | 4.5% HPA | 5.0% HPA |

|---|---|---|---|---|

| 1 | $362,250 | $364,000 | $365,750 | $367,500 |

| 2 | $374,928 | $378,560 | $381,215 | $385,875 |

| 3 | $388,051 | $393,702 | $397,364 | $405,169 |

| 4 | $401,633 | $409,450 | $414,237 | $425,427 |

| 5 | $415,690 | $425,828 | $431,868 | $446,698 |

| 6 | $430,239 | $442,861 | $450,294 | $469,033 |

| 7 | $445,296 | $460,575 | $469,554 | $492,485 |

| 8 | $460,880 | $478,998 | $489,689 | $517,109 |

| 9 | $477,008 | $498,158 | $510,741 | $542,965 |

| 10 | $493,703 | $518,084 | $532,754 | $570,113 |

Below is a graph illustrating the appreciation trajectory of the property over time:

Cash Flow and Home Price Appreciation

One of the most common questions we hear from investors is: Can I find a property that offers both strong appreciation potential and immediate cash flow? The answer is yes. Meridian Pacific Properties specializes in build-to-rent homes, designed to generate rental income from day one. We carefully select high-growth markets with strong rental demand, ensuring investors benefit from both steady cash flow and long-term property appreciation.

Memphis has consistently ranked among the top-performing markets for real estate investors, offering a rare combination of affordability, appreciation, and rental demand. Historically, home values in Memphis have appreciated at an average of 4 to 6 percent per year, driven by:

- A housing market that remains affordable compared to national averages

- Strong job growth and economic expansion attracting new residents

- High rental demand fueled by a steadily increasing population

- Favorable investment conditions with landlord-friendly policies

Investors in Memphis benefit from both steady home price appreciation and high rental yields, making it an ideal market for single-family rental investments. Consider the alternatives: an inexpensive home may generate cash flow but lack appreciation potential, while a high-end property may appreciate well but struggle to generate positive cash flow due to high costs.

At Meridian Pacific Properties, we focus on delivering the best of both worlds—a premium, well-located property designed to maximize returns while balancing cash flow and appreciation. Our homes are built and priced to provide investors with one of the most risk-adjusted, high-performing real estate investment options available today.

Home Price Appreciation Forecasts in Memphis

-

Realtor.com projects a 10.5% year-over-year increase in home prices for the Memphis MSA in 2025, positioning it among the top markets for price growth. (Read Article)

-

Redfin estimates a 4% rise in Memphis home prices for 2025, indicating steady appreciation. (Read Article)

Home Price Appreciation and Your Internal Rate of Return (IRR)

Internal Rate of Return (IRR) is a key metric used by real estate investors to evaluate the profitability of an investment over time. It measures the annualized rate of return an investor can expect, factoring in cash flow, appreciation, and the time value of money. Unlike simple return calculations, IRR provides a holistic view of an investment’s performance by accounting for the timing of cash inflows and outflows.

Being that home price appreciation (HPA) is the number one driver of IRR, this is a crucial factor to consider when investing in real estate. The more a property appreciates over time, the higher the IRR, amplifying overall returns beyond just rental income. While no one can predict market fluctuations with certainty, investors can look for key indicators of future growth to make informed decisions.

Two of the most critical factors to watch for are:

- Population growth – A rising population, primarily driven by job market expansion, increases demand for housing, pushing home values higher over time.

- Affordability – Markets where a smaller percentage of household income is required for housing expenses compared to the national average tend to have greater appreciation potential and long-term investment stability.

Memphis performs exceptionally well in both of these metrics, with a strong job market and affordability levels that are well below the national average. These conditions create a favorable environment for continued appreciation, making it an attractive choice for investors seeking high IRR and long-term wealth-building opportunities.

What Makes Investment Properties Appreciate?

1. Supply and Demand Dynamics

One of the fundamental drivers of home price appreciation is supply and demand. When demand for housing exceeds supply, home values increase. The SFR market has seen significant demand growth in recent years due to millennial homebuyers delaying homeownership, rising mortgage rates, and lifestyle shifts favoring rentals.

Example: Cities with strong job markets, such as Austin, Nashville, and Memphis, have seen rising home values due to an influx of workers seeking housing. Investors who purchase properties in these areas benefit from both high rental demand and property appreciation.

2. Inflation and Cost of Living Increases

Inflation naturally drives up the cost of goods and services, including real estate, labor, and materials. Over time, this translates to higher home prices. Investment properties benefit from inflation in two ways:

- Property values increase, raising the asset’s market price.

- Rental income rises, as landlords adjust rents to keep pace with inflation.

3. Market Trends and Economic Growth

Local and national economic growth plays a significant role in real estate appreciation. Markets with strong employment, infrastructure development, and population growth tend to see property values rise.

Key indicators that signal appreciation potential:

- Job growth and corporate expansions

- New transportation and infrastructure projects

- Increasing median household income

- Growth in local businesses and industries

4. Real Estate Cycles

Real estate operates in cycles, moving between phases of expansion, peak, contraction, and recovery. Investors who buy during market downturns and hold properties through growth periods capitalize on appreciation. Understanding these cycles helps investors time their purchases strategically.

Factors That Influence SFR Property Appreciation

1. Location Quality

The phrase “location, location, location” is especially true in real estate investing. Homes in desirable areas with strong job markets, good schools, and low crime rates tend to appreciate faster than those in declining areas.

High-appreciation markets typically have:

- Growing populations

- Major employers and job opportunities

- Desirable school districts

- Proximity to shopping, dining, and entertainment

- Low crime rates

At Meridian Pacific Properties, we only build homes in neighborhoods that have been carefully vetted. We consider local employers, job commute, tenant quality, area attractions and other factors that improve home price appreciation.

2. Property Condition and Improvements

Well-maintained properties appreciate better than neglected ones. Investors can force appreciation by making strategic upgrades such as:

- Renovating kitchens and bathrooms

- Upgrading flooring and appliances

- Improving curb appeal (landscaping, exterior painting)

- Enhancing energy efficiency (smart thermostats, insulation, solar panels)

If you are considering a previously owned investment property, be ready to make improvements. Older homes can require a lot of repairs and upgrades to be competitive in the rental market. Our investment properties are all brand new homes with premium upgrades, designed to provide long-term home price appreciation for Meridian investors.

3. Interest Rates and Lending Environment

Mortgage interest rates impact affordability and demand. Lower interest rates make homeownership more accessible, increasing property values. Conversely, higher rates can slow appreciation by reducing demand, but they often increase rental demand, benefiting SFR investors. When you purchase a property from Meridian, you can expect both price appreciation and immediate cash flow.

4. Rental Market Strength

SFR homes appreciate not just through market trends but also because of rental income potential. Markets with low rental supply and high tenant demand drive up home values, making these properties particularly attractive to investors.

How to Maximize Home Price Appreciation in SFR Investments

1. Choose the Right Market

Invest in cities and neighborhoods with strong economic fundamentals. Key indicators include:

- Population and job growth

- New business developments

- Rental demand exceeding supply

- Government investment in infrastructure

Top Markets for SFR Appreciation:

- Oakland, TN

- Horn Lake, MS

- Olive Branch, MS

- Sommerville, TN

2. Buy Below Market Value

One way to increase appreciation is to purchase properties below market value. Look for distressed sales, foreclosures, or motivated sellers. Instant equity upon purchase accelerates appreciation potential.

However, buying homes below market value comes with risks. Many of these properties require significant repairs to become rental-ready, cutting into potential profits. Investors should carefully assess renovation costs, potential vacancies, and long-term maintenance expenses.

A better strategy is to buy from a trusted builder offering incentives, like Meridian Pacific Properties. These homes are brand new, rental-ready, and come with built-in appreciation potential without the hidden costs and risks of distressed properties. One way to increase appreciation is to purchase properties below market value.

3. Take Advantage of Buyer Incentives

There are currently fantastic incentives being offered on investment properties. At Meridian Pacific Properties, we are currently offering up to $20,000 in incentives on select properties. This is a huge savings and will make a significant impact on the overall home price appreciation enjoyed by the homeowner. Schedule a call with Brian Conlon to learn more about our current specials.

4. Add Value Through Renovations

Improve key aspects of the property to boost its market value. Simple but effective upgrades include:

- Modernizing kitchens and bathrooms

- Adding energy-efficient features

- Enhancing landscaping and curb appeal

We understand that today’s renter is looking for and build homes specifically designed to increase in value. Meridian properties are Class A, premium homes with upgraded amenities renters love.

5. Hold for the Long-Term

Real estate appreciation compounds over time, making long-term hold strategies one of the most effective ways to maximize returns. Investors benefit not only from market-driven appreciation but also from steady rental income. We recommend viewing each property as a minimum 10-year investment to fully capitalize on its growth potential.

A smart approach is to start with one property and gradually expand your portfolio, adding new investments every few years. By reinvesting your returns, you can steadily increase your passive income while maximizing the appreciation of your real estate assets. This disciplined, long-term strategy builds wealth and financial stability over time.

6. Leverage Refinancing Opportunities

As home values increase, investors can refinance at lower interest rates or tap into home equity to acquire additional properties, further compounding their returns. A common saying in real estate is “Marry the house, date the rate.” This means that investors should focus on securing a high-quality property in a desirable neighborhood, rather than being deterred by current interest rates.

Over time, as the property appreciates in value and interest rates decline, investors can refinance to lower their monthly payments or free up capital for future investments. This strategy ensures that short-term rate fluctuations don’t prevent long-term wealth building through real estate.

How to Identify a Property with Strong Appreciation Potential

Not all properties appreciate at the same rate. Before investing, consider the following key factors to ensure your property has high appreciation potential:

- Location in a High-Growth Market – Choose cities or regions with strong job growth, population increases, and economic expansion. Markets with low housing supply and high demand tend to appreciate faster.

- New or Well-Maintained Home – New construction or recently renovated properties typically appreciate better than older homes with high maintenance costs. Quality construction and modern features add long-term value.

- Strong Rental Demand – In areas with high-quality tenants and low vacancy rates, home values rise due to consistent rental income potential, making the property more attractive to future buyers.

- Proximity to Amenities – Homes near good schools, shopping centers, parks, and transportation hubs tend to appreciate faster as they attract more buyers and renters.

- Builder Incentives & Smart Financing – Buying from a reputable builder offering incentives, like Meridian Pacific Properties, ensures you get a quality home with built-in appreciation potential, rather than a distressed property that requires costly repairs.

- Favorable Local Policies – Invest in areas with landlord-friendly regulations, tax benefits, and infrastructure investment, which contribute to long-term appreciation.

Why Appreciation Matters for SFR Investors

Home price appreciation is a powerful tool for building wealth through real estate. Single-family rental properties offer a unique combination of rental income, tax advantages, and equity growth that outperform many other investment options. By choosing the right locations, maintaining properties, and holding long-term, investors can maximize returns and build a sustainable portfolio.

For those seeking a hands-free, high-appreciation investment, turnkey SFR properties—like those offered by Meridian Pacific Properties—provide an excellent opportunity to benefit from appreciation without the operational burden of traditional real estate investing.

Please Share This Article

If you enjoyed this article, please share it. We appreciate your support and referrals.

Talk To The Author

Brian Conlon is the Director of Business Development at Meridian Pacific Properties. With years of experience in real estate investing and turnkey property management, Brian specializes in helping investors optimize cash flow, plan for long-term property performance, and navigate the complexities of real estate investing.

Schedule a consultation with Brian to learn more about investing in SFR investment properties.