Dear Investor,

Meridian Property Management spent a great deal of time working with tenants on collections over the past several weeks, working out payment timing arrangements and supporting tenants with their efforts to get their federal stimulus payments and unemployment benefits so that they could continue to pay their rent. April collections turned out quite strong, with 99.2% of the total rent roll collected during the month. Most of the rent deferral requests were made and satisfied within the month. We had only one deferral request that we approved for an early May payment.

Increasingly we have been getting inquiries about what is happening in the Memphis real estate market, and what the outlook is for investing there. In talking with our clients, I observe that investors are seeking a safer, less volatile alternative to the stock market that still offers strong returns. The S&P 500 dropped nearly 34% in just over a month between February 19th and March 23rd, but has begun to claw back, although we are still in the early stages of the current stock market recession. However, I do not believe that residential investment real estate is in a price recession, at least not in the Memphis market. I will offer my current observations.

Our leasing team is reporting seasonably normal leasing activity, and retail sales of new construction homes for sale have been strong. My colleagues in other metro areas in the southeastern and south central regions have reported the same thing. The news headlines are somewhat confusing, as they recently have reported “significant declines in sales”, which is true with respect to sales volume, but not really with home pricing, at least not in Memphis at this point.

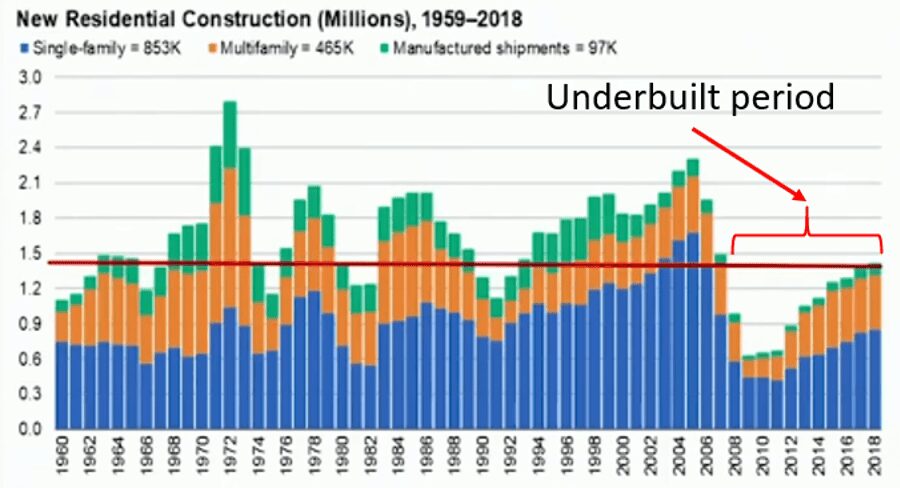

In the resale market, sellers have pulled their listings and buyers have not been visiting homes for sale in large numbers while there is still a material health risk. But since both supply and demand have both fallen simultaneously, pricing has generally remained intact. As the COVID sheltering sanctions decrease over time, I expect supply and demand will rise together, so I expect pricing will remain firm and eventually return to its normal trajectory. Since new construction homes are unoccupied, both prospective tenants and retail home buyers can visit them with reduced health risk even now. Since single family homes have been under built relative to nominal demand for about the last 10 years, outlook for at least the next 10 years appears to be robust, as indicated in the chart below.

John Burns November 2019

John Burns November 2019

As Mehran Aram, a noted real estate and mortgage analyst, stated on April 22nd, “Because the slowdown is self-imposed, because many are trying to abide by health officials’ guidance to remain home, experts believe that when the pandemic has passed, the housing market will come roaring back.”

On April 29th John Burns, one of the top national real estate consultants, in his opening remarks in a real estate webinar, said, “It’s our view and it seems to be everybody’s view that single family rental is going to be the first to stabilize and come out of this.” He went on to say that the build-to-rent sector will be the very first segment to rebound, as low supply of newly-built rental homes favors this sector and that capital seeking safety, yield and a hedge against inflation will come in. He mentioned that a key theme for housing is that there is now unprecedented consumer interest living in a nice home as they shift their focus from experiences to the home. He concluded that there will be “potential great news over the next few weeks and months, helped by tremendous government stimulus.”

I note that while Mr. Burns speaks of rentals being “first to recover”, in Memphis thus far the rental portfolio that we have been managing has barely been affected—there is little to recover from. He noted in his presentation that how markets will perform will vary widely by regional market. Because of Memphis’ lower exposure to the most COVID-impacted industries (i.e. leisure, hospitality, and retail), its stronger position in logistics and e-commerce, its comparatively limited number of COVID cases in the metro area, and the relative strength of Meridian’s tenant base (higher income earners more responsible about managing money), I believe Memphis real estate investment is now very well-positioned.

The plan to re-open Memphis was announced this week. Similar to other communities, there will be multiple phases. The first phase, beginning on May 4th, will allow restaurants and non-essential retailers to open at 50% capacity, with all employees being required to wear masks, and no groups of more than 10, Memphis Mayor Jim Strickland said. The second and third phases could occur as soon as two weeks apart if the medical data supports it, with each phase representing a gradual relaxation of work restrictions. This plan bodes well for getting the overall Memphis economy back on track.

In summary, based on my observations and synthesis of the data in the unusual health and economic environment we are experiencing, I believe this is good time to invest for a number of reasons:

– Notwithstanding the current economic and health crisis, shelter remains a basic human need for everyone, right along with food, and people will always use their capital to make sure that they keep their food and shelter first and foremost.

– The primary government support programs, including the CARES Act, extended unemployment benefits, and small and large business support programs, all directly support getting capital in the hands of people to support their basic needs while we weather the pandemic. The government has also expressed a willingness to continue supporting those programs if necessary. These moves have bought needed time to gradually resume economic activity.

– Memphis has been less impacted by COVID because of its lower population density and reduced exposure to the sectors of the economy that have suffered the most. Its employment strength in logistics and eCommerce has been stimulated by the

– Retail sales rent collections, and leasing have continued to be strong with respect to Meridian’s investment property base.

– While housing sales volume is down, homes prices have not been greatly affected because the supply of homes for sale has fallen at the same time.

– Memphis is implementing the first phase of its “go back to work” plan starting on May 4th, which will lower unemployment.

– The experts believe that the outlook specifically for single family residences (SFR’s) is especially healthy. As a nation, we have under built new SFR’s for more than a decade, and the fundamental demand for housing is still strong.

– For many people living in small spaces, such as apartments, they are highly motivated to seek the spacious, private, low-density living environment that SFR’s afford. This will be an important demand driver going forward for the SFR market.

– Pristine new construction is especially attractive in light of COVID health concerns.

We at Meridian have continued with our plans to build more single-family investment homes this year unabated. Real estate, especially residential property, has always been an attractive alternative investment. I believe over the course of time we will find that it performed well during the COVID crisis and beyond.

Sincerely,

Kevin Conlon

Principal

Meridian Pacific Properties

Meridian Property Management